Rise in Gadget Usage

The usage of personal gadgets, including tablets, laptops, and wearables, has escalated dramatically in recent years. Reports suggest that the average individual now owns at least three personal gadgets, which amplifies the risk of loss or damage. This trend is particularly evident among younger demographics, who are more inclined to invest in multiple devices. As the reliance on these gadgets intensifies, the Personal Gadget Insurance Market is poised for growth. Insurers are recognizing the need to provide comprehensive coverage options that address the unique vulnerabilities associated with various gadgets. This increasing usage of personal gadgets is likely to propel the demand for insurance solutions that safeguard against unforeseen incidents.

Evolving Consumer Expectations

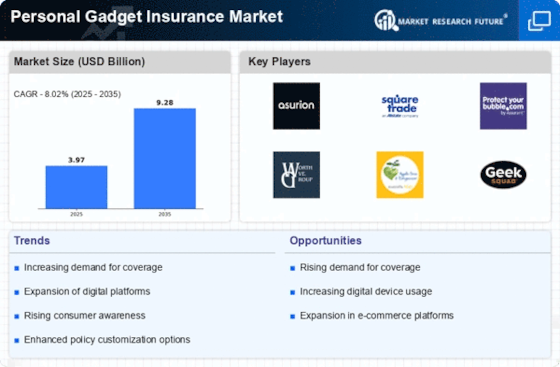

As consumers become more discerning, their expectations regarding insurance products are evolving. The Personal Gadget Insurance Market is witnessing a shift towards more flexible and user-friendly policies. Consumers now seek coverage that is not only comprehensive but also easily accessible and understandable. Insurers are responding by simplifying the claims process and offering customizable policies that cater to individual needs. This evolution in consumer expectations is likely to drive competition among insurers, leading to innovative solutions that enhance customer satisfaction. As a result, the Personal Gadget Insurance Market may experience significant growth as companies strive to meet these changing demands.

Increasing Smartphone Penetration

The proliferation of smartphones has been remarkable, with estimates indicating that over 3 billion smartphones are currently in use worldwide. This surge in smartphone ownership has led to a corresponding rise in the demand for Personal Gadget Insurance Market. As consumers increasingly rely on their devices for daily activities, the potential financial loss from damage or theft becomes a significant concern. Consequently, insurance providers are adapting their offerings to cater to this growing market, ensuring that policies are tailored to meet the specific needs of smartphone users. The increasing penetration of smartphones is likely to drive the Personal Gadget Insurance Market further, as more individuals seek protection for their valuable devices.

Growing Awareness of Insurance Benefits

There is a noticeable increase in consumer awareness regarding the benefits of insurance, particularly in the context of personal gadgets. Educational campaigns and marketing efforts by insurers have played a crucial role in informing consumers about the potential risks associated with gadget ownership. As individuals become more cognizant of the financial implications of loss or damage, the demand for Personal Gadget Insurance Market is expected to rise. This heightened awareness is fostering a culture of proactive risk management, where consumers are more inclined to invest in insurance as a safeguard against unforeseen events. Consequently, the Personal Gadget Insurance Market is likely to experience sustained growth as awareness continues to expand.

Technological Advancements in Insurance

Technological advancements are reshaping the insurance landscape, particularly within the Personal Gadget Insurance Market. The integration of artificial intelligence and machine learning is enabling insurers to streamline operations and enhance customer experiences. For instance, AI-driven claims processing can expedite the resolution of claims, making it more efficient for consumers. Additionally, the use of mobile applications allows policyholders to manage their insurance needs conveniently. These technological innovations not only improve operational efficiency but also attract tech-savvy consumers who value seamless interactions. As technology continues to evolve, the Personal Gadget Insurance Market is likely to benefit from increased adoption and engagement.