Expansion of E-commerce Platforms

The expansion of e-commerce platforms is transforming the retail landscape for the Period Cramp Supplement Market. With the convenience of online shopping, consumers are more inclined to purchase supplements from the comfort of their homes. This shift has been accompanied by an increase in the availability of various products, allowing consumers to explore a wider range of options. Market data suggests that online sales of period cramp supplements have experienced substantial growth, indicating a shift in consumer purchasing behavior. This trend is likely to continue, as e-commerce platforms enhance accessibility and provide detailed product information, further driving market growth.

Shift Towards Preventive Healthcare

The shift towards preventive healthcare is significantly influencing the Period Cramp Supplement Market. Consumers are increasingly prioritizing wellness and preventive measures over reactive treatments. This trend is reflected in the rising sales of dietary supplements aimed at managing menstrual discomfort. Market analysis shows that the preventive approach is gaining traction, with a growing segment of the population opting for supplements that can mitigate symptoms before they escalate. This proactive mindset is likely to drive innovation and product development within the industry, as manufacturers respond to the demand for effective preventive solutions.

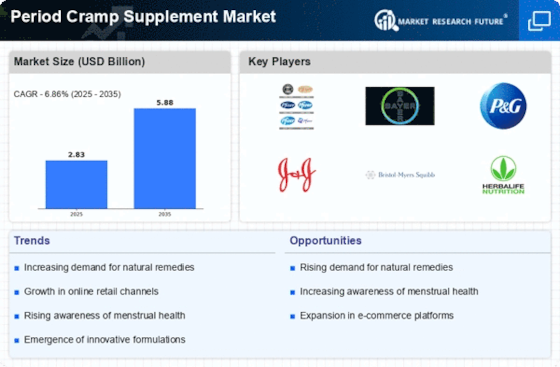

Increasing Awareness of Menstrual Health

The growing awareness surrounding menstrual health is a pivotal driver for the Period Cramp Supplement Market. As more individuals recognize the impact of menstrual cramps on their quality of life, there is a heightened demand for effective solutions. Educational campaigns and social media discussions have contributed to this awareness, leading to an increase in the consumption of period cramp supplements. Market data indicates that the demand for these products has surged, with a notable rise in sales reported in recent years. This trend suggests that consumers are actively seeking remedies that can alleviate discomfort, thereby propelling the growth of the industry.

Influence of Social Media and Influencers

The influence of social media and influencers is reshaping consumer perceptions and purchasing decisions within the Period Cramp Supplement Market. Platforms such as Instagram and TikTok have become vital channels for brands to engage with their audience, promoting products through authentic testimonials and reviews. This trend has led to increased visibility for period cramp supplements, as influencers share their personal experiences and recommendations. Market data indicates that products endorsed by influencers often see a spike in sales, highlighting the power of social media in driving consumer behavior. This dynamic is likely to continue, as brands leverage influencer partnerships to enhance their market presence.

Rising Demand for Vegan and Organic Products

The rising demand for vegan and organic products is a notable driver in the Period Cramp Supplement Market. As consumers become more health-conscious and environmentally aware, there is a growing preference for supplements that align with these values. This trend is reflected in the increasing availability of vegan and organic period cramp supplements, which cater to a niche market seeking natural alternatives. Market Research Future indicates that the sales of organic supplements have seen a significant uptick, suggesting that consumers are willing to invest in products that are perceived as healthier and more sustainable. This shift is likely to encourage manufacturers to innovate and expand their product lines.