Market Growth Projections

The Global Natural Fragrances Industry is poised for substantial growth, with projections indicating a market value of 27.8 USD Billion in 2024 and an anticipated increase to 60.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.25% from 2025 to 2035. Such figures reflect the increasing consumer preference for natural ingredients and the ongoing shift towards sustainability in product formulations. The market's expansion is likely to be driven by various factors, including rising awareness of health and environmental issues, regulatory support for natural products, and technological advancements in extraction methods.

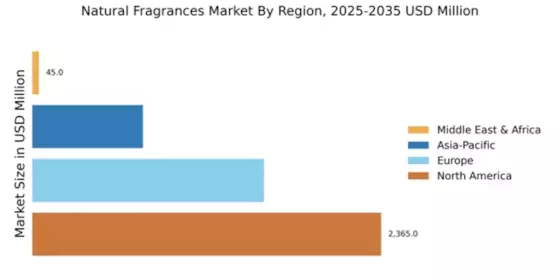

Emerging Markets and Global Expansion

Emerging markets are playing a crucial role in the expansion of the Global Natural Fragrances Industry. Regions such as Asia-Pacific and Latin America are witnessing a rise in disposable incomes and changing consumer preferences, leading to increased demand for natural fragrances. As global brands seek to penetrate these markets, they are adapting their product offerings to cater to local tastes and preferences. This strategic expansion is expected to contribute to the overall growth of the market, with projections indicating a robust increase in market value. The combination of rising incomes and a shift towards natural products positions these regions as key players in the industry's future.

Sustainability and Environmental Concerns

Sustainability plays a pivotal role in shaping the Global Natural Fragrances Industry. As environmental concerns escalate, consumers and manufacturers alike are prioritizing eco-friendly practices. The demand for sustainably sourced ingredients is on the rise, prompting companies to adopt responsible sourcing and production methods. This shift not only caters to consumer preferences but also aligns with global sustainability goals. The market is expected to grow significantly, with projections indicating a value of 60.0 USD Billion by 2035. Companies that embrace sustainability are likely to gain a competitive edge, as they resonate with environmentally conscious consumers.

Regulatory Support for Natural Ingredients

The Global Natural Fragrances Industry benefits from increasing regulatory support for natural ingredients. Governments worldwide are implementing stricter regulations on synthetic chemicals, thereby encouraging the use of natural alternatives. This regulatory landscape fosters innovation and investment in the development of natural fragrance products. As a result, manufacturers are more inclined to explore natural formulations, which can lead to enhanced product offerings. The anticipated compound annual growth rate of 7.25% from 2025 to 2035 underscores the potential for growth in this sector, as businesses adapt to comply with evolving regulations and consumer expectations.

Rising Consumer Demand for Natural Products

The Global Natural Fragrances Industry is experiencing a notable surge in consumer demand for natural and organic products. This trend is largely driven by increasing awareness of the harmful effects of synthetic chemicals in personal care and household products. As consumers become more health-conscious, they are gravitating towards products that are perceived as safer and more environmentally friendly. In 2024, the market is projected to reach 27.8 USD Billion, reflecting a growing preference for natural fragrances that align with sustainable living. This shift is likely to continue, as consumers increasingly seek transparency in ingredient sourcing and production processes.

Technological Advancements in Extraction Methods

Technological advancements in extraction methods are significantly influencing the Global Natural Fragrances Industry. Innovations such as supercritical CO2 extraction and cold pressing are enhancing the efficiency and quality of natural fragrance production. These methods allow for the preservation of delicate aromatic compounds, resulting in superior fragrance profiles. As technology continues to evolve, manufacturers are likely to adopt these advanced techniques, leading to a broader range of high-quality natural fragrances. This trend not only meets consumer demand for authenticity but also supports the market's growth trajectory, as companies strive to differentiate their products in a competitive landscape.