Growing Interest in Sports Nutrition

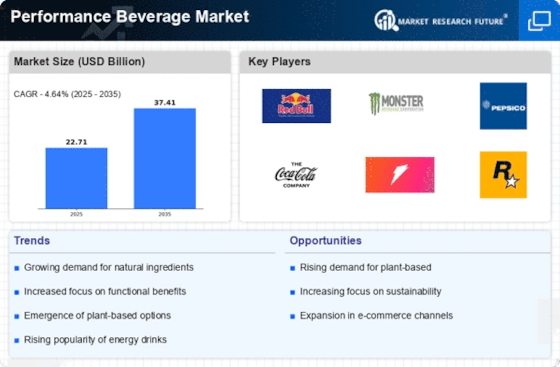

The Performance Beverage Market is benefiting from a growing interest in sports nutrition among consumers of all ages. As more individuals engage in fitness activities and sports, there is an increasing awareness of the importance of proper nutrition for performance enhancement. This trend is reflected in the rising sales of sports drinks and protein-infused beverages, which are projected to grow at a rate of 7% annually. The demand for products that support endurance, hydration, and muscle recovery is driving innovation in the market. Brands are now focusing on creating beverages that cater to the specific needs of athletes and fitness enthusiasts, thereby expanding their product offerings and enhancing market competitiveness.

Increased Demand for Functional Beverages

The Performance Beverage Market is experiencing a notable surge in demand for functional beverages that offer specific health benefits. Consumers are increasingly seeking products that enhance physical performance, improve recovery, and provide mental clarity. This trend is supported by data indicating that the functional beverage segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years. As athletes and fitness enthusiasts prioritize performance-enhancing products, brands are responding by innovating formulations that include ingredients such as electrolytes, amino acids, and adaptogens. This shift towards functional beverages reflects a broader consumer preference for products that not only quench thirst but also contribute to overall well-being.

Emerging Trends in Plant-Based Ingredients

The Performance Beverage Market is experiencing a notable shift towards the incorporation of plant-based ingredients in beverage formulations. As consumers become more health-conscious and environmentally aware, there is a growing preference for beverages that utilize natural, plant-derived components. This trend is reflected in the increasing availability of performance beverages that feature ingredients such as plant proteins, herbal extracts, and natural sweeteners. Data indicates that the plant-based beverage segment is expected to grow by over 10% in the coming years. This shift not only caters to the demand for healthier options but also aligns with the broader movement towards sustainability and ethical consumption, positioning brands favorably in a competitive market.

Innovations in Packaging and Product Formats

The Performance Beverage Market is undergoing a transformation with innovations in packaging and product formats. Brands are increasingly adopting eco-friendly packaging solutions and convenient formats that appeal to on-the-go consumers. For instance, single-serve pouches and ready-to-drink formats are gaining popularity, as they offer convenience and portability. This shift is supported by consumer preferences for sustainable packaging, which is becoming a critical factor in purchasing decisions. As brands innovate in packaging, they not only enhance the consumer experience but also align with sustainability goals, potentially attracting a broader customer base and driving sales in the performance beverage sector.

Rise of E-commerce and Direct-to-Consumer Sales

The Performance Beverage Market is witnessing a significant transformation due to the rise of e-commerce and direct-to-consumer sales channels. With the increasing penetration of the internet and mobile devices, consumers are more inclined to purchase performance beverages online. Data suggests that online sales of beverages have seen a remarkable increase, with e-commerce accounting for nearly 20% of total beverage sales in recent years. This shift allows brands to reach a wider audience and engage directly with consumers, fostering brand loyalty and personalized marketing strategies. As convenience becomes a priority for consumers, the ability to order performance beverages online is likely to drive further growth in the industry.