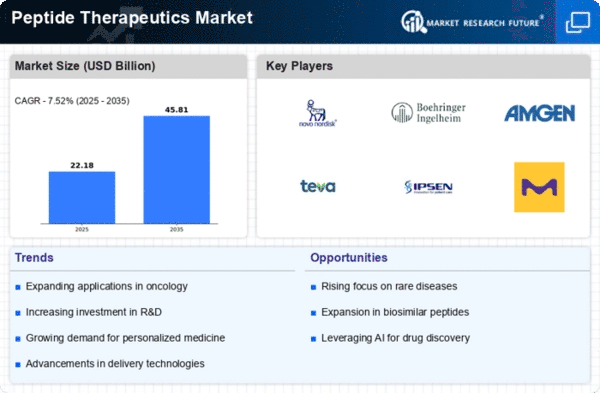

Market Growth Projections

The Global Peptide Therapeutics Market Industry is projected to experience substantial growth over the next decade. With a market valuation of 20.6 USD Billion in 2024, it is expected to reach 45.8 USD Billion by 2035, demonstrating a compound annual growth rate of 7.52% from 2025 to 2035. This growth is driven by various factors, including the rising prevalence of chronic diseases, advancements in peptide synthesis technologies, and increased investment in biopharmaceutical research. The market's expansion reflects the growing recognition of peptide therapeutics as effective treatment options, positioning them as a critical component of future healthcare solutions.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as diabetes, cancer, and cardiovascular disorders is a primary driver of the Global Peptide Therapeutics Market Industry. As of 2024, the market is valued at approximately 20.6 USD Billion, reflecting a growing demand for innovative treatment options. Peptides, known for their specificity and reduced side effects, are gaining traction as effective therapeutic agents. For instance, peptide-based drugs like insulin and GLP-1 receptor agonists are widely used in diabetes management. This trend is expected to continue, with the market projected to reach 45.8 USD Billion by 2035, indicating a robust growth trajectory fueled by the need for targeted therapies.

Regulatory Support for Peptide Therapeutics

Regulatory bodies are increasingly providing support for the development and approval of peptide therapeutics, which is a crucial driver for the Global Peptide Therapeutics Market Industry. Streamlined regulatory pathways and guidelines for peptide drugs are encouraging pharmaceutical companies to invest in this area. For instance, the FDA has established frameworks that facilitate the expedited review of peptide-based therapies, particularly those addressing critical health issues. This regulatory environment not only accelerates the time to market but also enhances the attractiveness of peptide therapeutics for investors. As a result, the market is poised for substantial growth in the coming years.

Advancements in Peptide Synthesis Technologies

Technological advancements in peptide synthesis are significantly influencing the Global Peptide Therapeutics Market Industry. Innovations such as solid-phase peptide synthesis and automated synthesizers have enhanced the efficiency and scalability of peptide production. These developments not only reduce costs but also improve the quality and purity of peptides, making them more viable for therapeutic applications. As a result, pharmaceutical companies are increasingly investing in peptide-based drug development. The market's growth is further supported by the anticipated compound annual growth rate of 7.52% from 2025 to 2035, driven by these technological improvements that facilitate the creation of novel peptide therapeutics.

Growing Investment in Biopharmaceutical Research

The surge in investment directed towards biopharmaceutical research is propelling the Global Peptide Therapeutics Market Industry forward. Governments and private entities are recognizing the potential of peptide therapeutics in addressing unmet medical needs. This has led to increased funding for research and development initiatives aimed at discovering new peptide-based drugs. For example, various countries are establishing grants and incentives to support biotech firms focused on peptide research. The market's valuation is expected to grow from 20.6 USD Billion in 2024 to 45.8 USD Billion by 2035, highlighting the impact of sustained investment in this sector.

Emerging Applications in Oncology and Metabolic Disorders

The expanding applications of peptide therapeutics in oncology and metabolic disorders are significantly shaping the Global Peptide Therapeutics Market Industry. Peptides are being explored for their potential in targeted cancer therapies and metabolic regulation, offering new avenues for treatment. For example, peptide vaccines are gaining attention in cancer immunotherapy, while peptide analogs are being utilized in the management of obesity and metabolic syndrome. This diversification of applications is likely to contribute to the market's growth, with projections indicating a rise from 20.6 USD Billion in 2024 to 45.8 USD Billion by 2035, reflecting the increasing recognition of peptides as versatile therapeutic agents.