Market Share

PEGylated Drugs Market Share Analysis

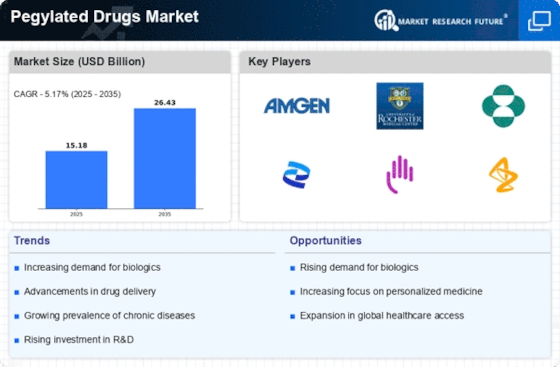

The growth of biopharmaceutical companies that focus on developing biologics is continuing, and this is largely due to several advantages these biologics offer. Biologics have fewer issues related to toxicity and are highly specific in targeting, especially when compared to small-molecule drugs. There are two significant areas of progress within biologics: regenerative therapy and advanced personalized medicines. Additionally, exciting developments in immunotherapies, gene and cell therapies, and antibody-drug conjugates are anticipated to make a significant impact on the global PEGylated drugs market.

One of the main reasons for the ongoing success of biopharmaceutical companies in the development of biologics is the favorable characteristics these drugs possess. Unlike small-molecule drugs, biologics have minimal problems with toxicity, meaning they are less likely to cause harmful side effects. Moreover, they exhibit high specificity in targeting, which means they can precisely target specific cells or molecules in the body, making them more effective in treating diseases.

Within the realm of biologics, two areas are advancing rapidly: regenerative therapy and advanced personalized medicines. Regenerative therapy involves using the body's own mechanisms to repair or replace damaged tissues, providing new and promising approaches to treating various conditions. Advanced personalized medicines tailor treatments to individual patients based on their unique characteristics, ensuring more personalized and effective healthcare.

Exciting progress is also being made in other biologic fields, such as immunotherapies, gene and cell therapies, and antibody-drug conjugates. Immunotherapies aim to enhance the body's immune system to fight diseases, while gene and cell therapies involve manipulating genes and cells to treat or prevent illnesses. Antibody-drug conjugates combine antibodies with drugs to precisely deliver treatment to specific cells, minimizing damage to healthy cells.

These advancements in biologics, particularly in regenerative therapy, personalized medicines, and other cutting-edge fields, are expected to play a crucial role in boosting the global PEGylated drugs market. PEGylated drugs, which involve attaching chains of ethylene glycol to therapeutic molecules, have proven effective in enhancing drug delivery and improving treatment outcomes.

The growing acceptance of biologics, including PEGylated drugs like monoclonal antibodies, colony-stimulating factors, and interferons, for treating chronic diseases like cancer, is expected to increase their revenue share in developed regions. Monoclonal antibodies are proteins that can target specific cells and have been successful in treating various diseases. Colony-stimulating factors and interferons are substances that can boost the immune system and are used in the treatment of conditions like cancer.

This increasing adoption of biologics, especially in the treatment of chronic diseases, is set to drive the growth of the PEGylated drugs market. Developed regions, where these biologics are gaining traction, are expected to contribute significantly to the market's expansion. The positive outcomes observed in treating chronic diseases, particularly cancer, with PEGylated drugs underline the potential for further growth in the market.

Leave a Comment