Rising Cybersecurity Threats

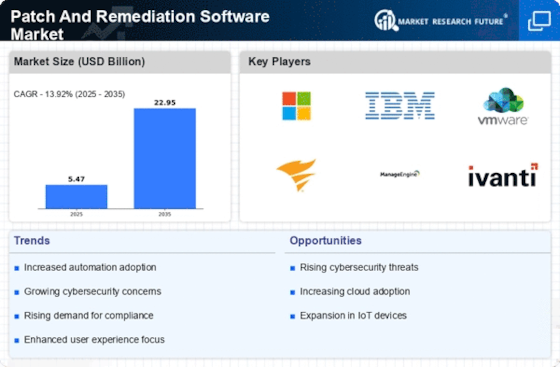

The Patch And Remediation Software Market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to adopt robust patch management solutions to safeguard their systems against vulnerabilities. In 2025, it is estimated that cybercrime will cost businesses over 10 trillion dollars annually, underscoring the urgency for effective remediation strategies. As cyber threats evolve, the need for timely updates and patches becomes paramount, driving investments in patch and remediation software. This trend indicates that companies are prioritizing cybersecurity measures, which in turn fuels the growth of the patch and remediation software market.

Focus on Operational Efficiency

Organizations are increasingly recognizing the importance of operational efficiency, which is a key driver for the Patch And Remediation Software Market. Efficient patch management processes can reduce downtime, enhance system performance, and minimize security risks. As businesses strive to optimize their operations, the demand for software that automates and simplifies patching tasks is likely to grow. In 2025, the operational efficiency software market is expected to reach 25 billion dollars, indicating a strong link between the pursuit of efficiency and the adoption of patch and remediation solutions. This trend suggests that organizations are prioritizing tools that not only secure their systems but also enhance overall productivity.

Adoption of Cloud-Based Solutions

The shift towards cloud computing is significantly influencing the Patch And Remediation Software Market. As organizations migrate their operations to the cloud, the need for effective patch management becomes critical to ensure the security of cloud-based applications and services. Cloud environments often require different patching strategies compared to traditional on-premises systems, leading to an increased demand for specialized patch and remediation software. By 2025, it is anticipated that the cloud services market will surpass 500 billion dollars, highlighting the potential for growth in the patch management sector as businesses seek to secure their cloud infrastructures.

Regulatory Compliance Requirements

Compliance with various regulatory frameworks is a significant driver for the Patch And Remediation Software Market. Organizations are mandated to adhere to standards such as GDPR, HIPAA, and PCI DSS, which necessitate regular updates and patches to maintain data security and privacy. Failure to comply can result in hefty fines and reputational damage. As regulations become more stringent, the demand for effective patch management solutions is likely to increase. In 2025, the market for compliance-related software is projected to reach 12 billion dollars, indicating a strong correlation between regulatory pressures and the growth of the patch and remediation software market.

Growing Complexity of IT Environments

The increasing complexity of IT environments, characterized by a mix of on-premises, cloud, and hybrid systems, is driving the demand for the Patch And Remediation Software Market. Organizations are faced with the challenge of managing diverse systems and applications, which complicates the patching process. As IT infrastructures become more intricate, the need for automated and efficient patch management solutions is likely to rise. In 2025, the market for IT management software is projected to reach 30 billion dollars, suggesting that businesses are investing heavily in tools that can streamline their patch and remediation efforts amidst growing complexity.