January 2025

Bridgestone India Projects 7-8% Growth in Replacement Demand

On January 21, 2025, Bridgestone India announced an anticipated 7-8% growth in tire replacement demand for the year. This projection follows disruptions experienced in 2024 due to various factors. To support this growth, the company unveiled an $85 million investment plan aimed at enhancing production capacity and capabilities at its Pune and Indore plants.

This initiative includes the establishment of a satellite technology center at the Pune facility to develop "Dan-Totsu" products, tailored for the Indian market using the ENLITEN technology platform. Additionally, Bridgestone India is expanding its market presence into tier 3 and 4 towns, aiming to increase its market share in the replacement segment from the current 20% to 25% in the long term.

February 2025

U.S. Judge Dismisses Price-Fixing Lawsuits Against Major Tire Manufacturers

On February 26, 2025, a U.S. judge dismissed class-action lawsuits accusing Goodyear, Bridgestone, and other tire manufacturers of conspiring to overcharge consumers and businesses for replacement tires. The judge ruled that the plaintiffs failed to provide adequate evidence of a conspiracy. The lawsuits alleged that the companies coordinated to fix prices during the COVID-19 pandemic, but the court found insufficient links between the alleged conduct in Europe and practices in the U.S. Plaintiffs were given until March 25 to amend their complaints.

Bridgestone Announces Closure of Tennessee Plant, Resulting in 700 Layoffs

In February 2025, Bridgestone Americas announced the closure of its LaVergne, Tennessee, truck and bus radial tire plant, leading to approximately 700 layoffs. This decision is part of a broader strategy to optimize the company's business footprint and enhance competitiveness amid challenging economic conditions. Affected employees have preferential hiring rights at other Bridgestone facilities.

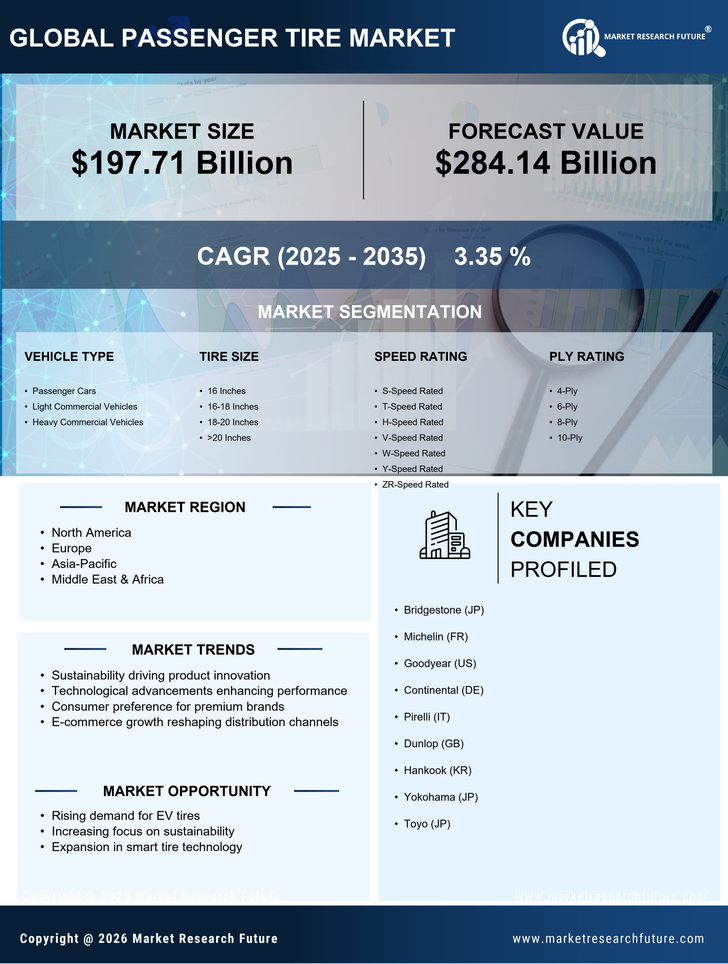

The Passenger Tire Market is projected to reach USD 274.93 billion by 2034, exhibiting a CAGR of 3.35% during the forecast period (2025-2034). Rising demand for passenger vehicles, particularly in emerging economies, is a key driver of market growth. Growing awareness of safety and fuel efficiency is also fueling demand for high-performance tires.

The increasing adoption of electric vehicles is expected to create new opportunities for the passenger tire market as these vehicles require specialized tires designed to handle the unique characteristics of electric motors.Recent news developments include the launch of new tire technologies such as self-sealing tires and airless tires. These technologies aim to improve safety, convenience, and durability. Additionally, major tire manufacturers are investing in sustainable practices and developing eco-friendly tires to meet growing consumer demand for environmentally conscious products.