Research Methodology on Paper Straw Market

1. Introduction:

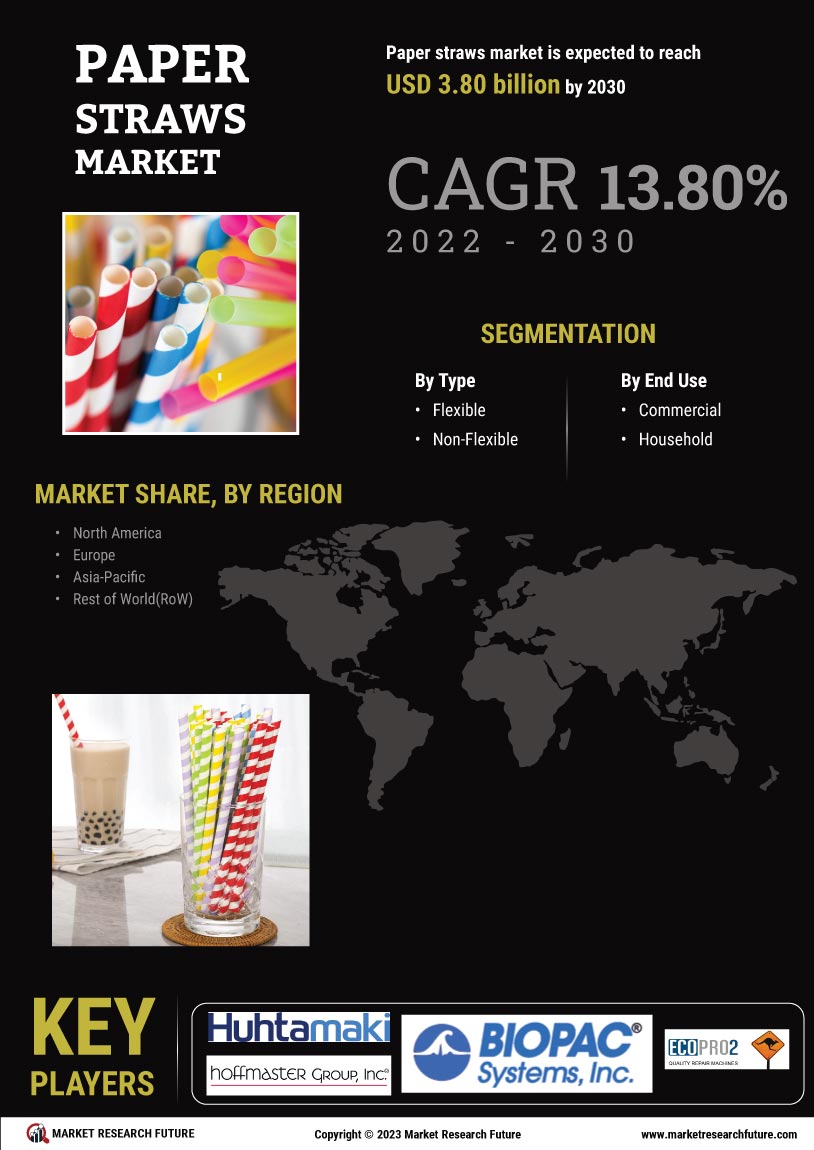

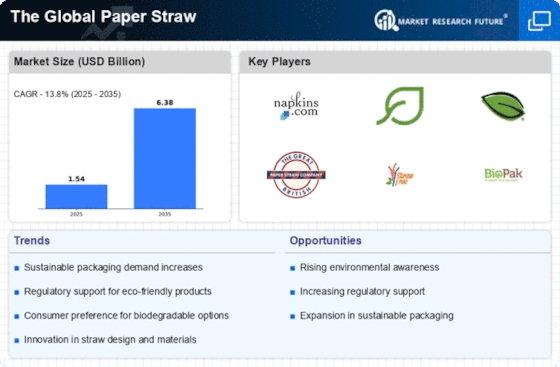

Paper straws are a rising trend in the world of sustainability and innovation. Although plastic straws are the more popular choice, paper straws are gaining recognition due to their eco-friendly, cost-effective, and lightweight properties. This paper strives to understand the worldwide perspectives, trends, drivers, and challenges of the paper straw market.

2. Research Objectives:

The general objective of this research is to understand the paper straw market dynamics, trends, drivers, and challenges. More specifically, this research seeks to:

- Identify the factors driving growth in the paper straw market.

- Assess the current trends in the paper straw market.

- Identify the challenges faced by paper straw manufacturers and users.

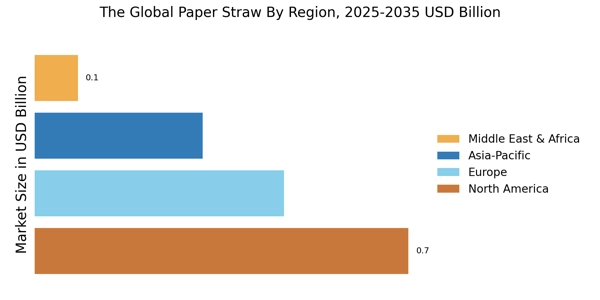

- Analyse the regional and global perspectives of the paper straw market.

- Estimate the futuristic scenario of the paper straw market.

3. Research Design:

This research is a comprehensive qualitative and quantitative assessment of the paper straw market. The research design followed in this research is a combination of primary and secondary sources.

3.1 Primary Research:

For this research, primary data is collected from experts in the paper straw industry. Primary data collection includes industry professionals, manufacturers, suppliers, distributors, and end-users. The personal interviews are conducted face-to-face or via telephone. The personal interviews were conducted with executives from leading companies and stakeholders. The primary data gathered helped in validating and strengthen the research findings.

3.2 Secondary Research:

Secondary research includes an extensive review of the existing industry reports and publications. Secondary sources include trade and business journals, company websites, and other industry-related electronic databases. Scientific sources, such as government and non-governmental organizations, universities, and media sources are also included in the findings.

4. Data Collection:

The survey is conducted to understand the paper straw market dynamics and is designed to gather insights from stakeholders and industry professionals regarding the current trends, barriers, restraints, opportunities, and drivers in the paper straw market.

The survey is conducted through digital channels such as Google Forms, web surveys, and telephone interviews. A sample size of 75 experts from the paper straw industry is utilized for the survey and a convenience sampling method is employed for the data collection.

5. Sampling Method:

The sampling method employed for this study is the convenience sampling method. For the convenience sampling method, the sample size is small i.e. 75. The respondents of this survey were chosen from industry experts based on systematic random sampling.

6. Data Analysis:

A detailed analysis of the collected primary and secondary data is performed. The data collated from the available sources is analyzed with the help of various tools. The variables considered for the analysis are Global Industry Insights, Market Overview, Product Types and Applications, Market Size & Forecasts, Key Statistics, and Regional & Global Perspectives.

For the market size & insights segment, the current, past, and future market trends are analyzed. For assessment of the global and regional market, market volume and market share are evaluated. Descriptive statistics of each variable are also featured in the report. The data collected is filtered for accuracy and precision. After the analysis of the data, the results are incorporated into the report.

7. Conclusion:

This research provides an in-depth analysis of the paper straw market and provides a holistic assessment of the current trends, drivers, restraints, and future development opportunities in the paper straw market. Furthermore, the report provides a comprehensive understanding of the regional and global perspectives of the paper straw market.