Regulatory Support

Regulatory support plays a crucial role in propelling The Global Paper Straw Industry forward. Governments across various regions are implementing bans on single-use plastics, which directly benefits the paper straw sector. For instance, several countries have enacted legislation that restricts the use of plastic straws in restaurants and cafes, thereby creating a favorable environment for paper straw manufacturers. This regulatory landscape is expected to continue evolving, with more stringent measures likely to be introduced in the coming years. The market is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030, driven by these supportive policies. Consequently, The Global Paper Straw Industry is positioned to capitalize on this momentum, as businesses adapt to comply with new regulations while meeting consumer demand for sustainable products.

Consumer Preferences

Shifting consumer preferences are significantly influencing The Global Paper Straw Industry. As awareness of environmental issues rises, consumers are increasingly opting for eco-friendly products, including paper straws. Market Research Future indicates that approximately 60% of consumers are willing to pay a premium for sustainable alternatives, which has prompted manufacturers to innovate and diversify their product offerings. This trend is particularly evident in the food and beverage sector, where establishments are actively replacing plastic straws with paper options to align with customer values. The Global Paper Straw Industry is thus experiencing a paradigm shift, as businesses recognize the importance of catering to this evolving consumer mindset. The demand for paper straws is expected to continue its upward trajectory, driven by the desire for sustainable and responsible consumption.

Sustainability Initiatives

The increasing emphasis on sustainability initiatives is a primary driver for The Global Paper Straw Industry. As consumers become more environmentally conscious, there is a growing demand for alternatives to plastic straws. This shift is reflected in various legislative measures aimed at reducing plastic waste, which have led to a surge in the adoption of paper straws. In 2023, the market for paper straws was valued at approximately 1.2 billion USD, indicating a robust growth trajectory. Companies are now investing in sustainable sourcing of materials, which not only meets consumer expectations but also aligns with corporate social responsibility goals. The Global Paper Straw Industry is thus witnessing a transformation, as businesses strive to enhance their sustainability profiles while catering to a more eco-aware customer base.

Technological Advancements

Technological advancements are reshaping The Global Paper Straw Industry by enhancing the quality and functionality of paper straws. Innovations in manufacturing processes have led to the development of more durable and water-resistant paper straws, addressing previous concerns regarding their usability. These advancements not only improve the consumer experience but also expand the potential applications of paper straws in various sectors, including hospitality and retail. The introduction of new designs and features, such as biodegradable coatings, is further driving market growth. As of 2023, the market is estimated to have grown by 15% due to these technological improvements. The Global Paper Straw Industry is thus poised for continued expansion, as manufacturers leverage technology to meet the demands of a discerning consumer base.

Market Expansion Opportunities

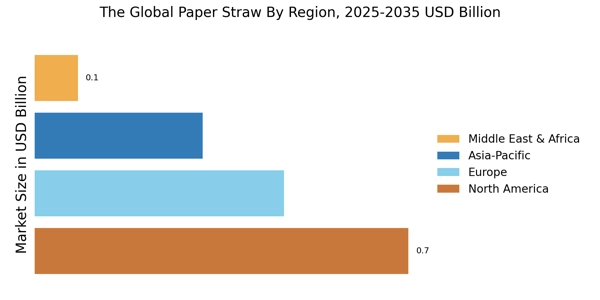

Market expansion opportunities are emerging as a key driver for The Global Paper Straw Industry. With the increasing global focus on sustainability, new markets are opening up for paper straw manufacturers. Regions that were previously dominated by plastic products are now exploring alternatives, creating a fertile ground for growth. For instance, the Asia-Pacific region is witnessing a surge in demand for paper straws, driven by rising disposable incomes and changing consumer habits. This trend is expected to contribute to a projected market growth of 8% annually over the next five years. Additionally, partnerships between manufacturers and retailers are becoming more common, facilitating wider distribution and accessibility of paper straws. The Global Paper Straw Industry is thus likely to benefit from these expansion opportunities, as businesses seek to tap into new consumer bases and enhance their market presence.