Pallets Market Summary

As per Market Research Future analysis, the Pallets Market Size was estimated at 68.65 USD Billion in 2024. The Pallets industry is projected to grow from 71.6 USD Billion in 2025 to 109.11 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Pallets Market is currently experiencing a shift towards sustainability and technological integration.

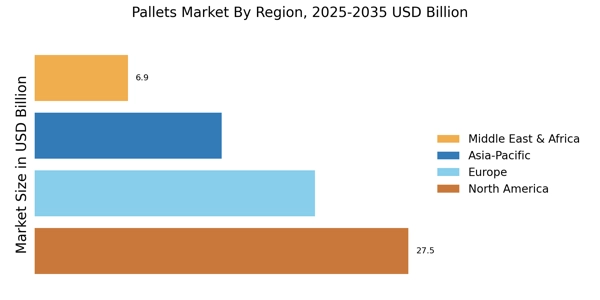

- North America remains the largest market for pallets, driven by robust industrial activity and e-commerce growth.

- Asia-Pacific is the fastest-growing region, reflecting increasing manufacturing and logistics demands.

- Wood pallets continue to dominate the market, while plastic pallets via injection molding are gaining traction due to their versatility.

- E-commerce growth and sustainability regulations are key drivers influencing the market dynamics.

Market Size & Forecast

| 2024 Market Size | 68.65 (USD Billion) |

| 2035 Market Size | 109.11 (USD Billion) |

| CAGR (2025 - 2035) | 4.3% |

Major Players

CHEP (AU), PalletOne (US), MHI (US), Schoeller Allibert (NL), Pallets & Skids (US), UFP Industries (US), Kuehne + Nagel (DE), Greif (US), Bergschenhoek (NL), Pallets Direct (AU)