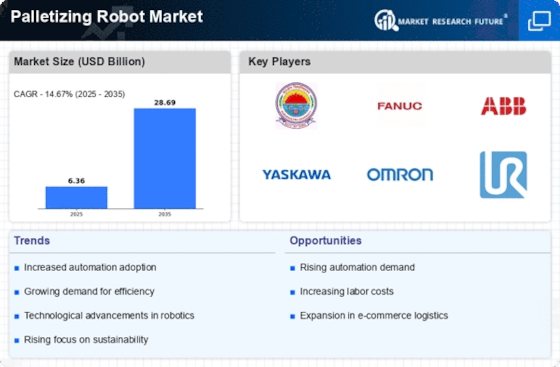

The Palletizing Robot Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for automation across various industries. Key players such as KUKA (Germany), FANUC (Japan), and ABB (Switzerland) are strategically positioning themselves through innovation and regional expansion. KUKA (Germany) focuses on enhancing its product offerings with advanced AI capabilities, while FANUC (Japan) emphasizes its strong presence in Asia, leveraging its extensive distribution network. ABB (Switzerland) is actively pursuing partnerships to integrate its robotics solutions with digital platforms, thereby enhancing operational efficiency. Collectively, these strategies contribute to a competitive environment that is increasingly centered around technological differentiation and customer-centric solutions. In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several players vying for market share. However, the influence of major companies is substantial, as they set industry standards and drive innovation. This competitive structure encourages smaller firms to innovate rapidly, thereby fostering a vibrant ecosystem of technological advancement. In August 2025, KUKA (Germany) announced the launch of its new AI-driven palletizing robot, which is designed to enhance flexibility in production lines. This strategic move is significant as it aligns with the growing trend towards smart manufacturing, allowing companies to adapt quickly to changing market demands. The introduction of AI capabilities not only improves efficiency but also positions KUKA as a leader in the integration of advanced technologies in robotics. In September 2025, FANUC (Japan) expanded its operations in Southeast Asia by establishing a new manufacturing facility in Vietnam. This expansion is crucial as it allows FANUC to tap into the rapidly growing market for automation in the region, thereby enhancing its competitive edge. The facility is expected to streamline production processes and reduce costs, which could lead to increased market penetration and customer acquisition. In July 2025, ABB (Switzerland) entered into a strategic partnership with a leading software company to develop a cloud-based platform for robotics management. This collaboration is indicative of ABB's commitment to digital transformation and reflects the industry's shift towards integrated solutions. By combining robotics with cloud technology, ABB aims to provide customers with enhanced data analytics capabilities, thereby improving operational decision-making and efficiency. As of October 2025, the Palletizing Robot Market is witnessing trends such as digitalization, sustainability, and AI integration, which are reshaping competitive dynamics. Strategic alliances are becoming increasingly important, as companies seek to leverage complementary strengths to enhance their offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability. This shift underscores the necessity for companies to invest in advanced technologies and collaborative partnerships to maintain a competitive advantage.

.png)