E-commerce Growth

The rise of e-commerce has a profound impact on the Global Packaging Material Market Industry, necessitating innovative packaging solutions that ensure product safety during transit. With online retail sales expected to continue their upward trajectory, packaging materials must adapt to meet the demands of shipping and handling. This includes the use of protective packaging, such as bubble wrap and molded pulp, which are essential for fragile items. As e-commerce expands, the market is likely to experience a compound annual growth rate of 4.0% from 2025 to 2035, further driving the need for specialized packaging materials.

Consumer Preferences

Shifting consumer preferences significantly influence the Global Packaging Material Market Industry, as buyers increasingly seek convenience and functionality in packaging. The demand for easy-to-open, resealable, and portion-controlled packaging is on the rise, particularly in the food and beverage sector. This trend is driven by busy lifestyles and a growing focus on health and wellness. Brands that respond to these preferences are likely to gain a competitive edge, thereby propelling market growth. As consumer expectations evolve, the market is poised for substantial expansion, aligning with the projected figures for 2024 and beyond.

Regulatory Compliance

Regulatory compliance is a driving force in the Global Packaging Material Market Industry, as governments worldwide implement stricter guidelines on packaging materials. These regulations often focus on reducing plastic waste and promoting recycling initiatives. Companies must adapt their packaging strategies to meet these requirements, which may involve investing in alternative materials or redesigning existing products. Compliance not only mitigates legal risks but also enhances brand reputation among environmentally conscious consumers. As the market adapts to these regulations, it is expected to grow in tandem with the increasing emphasis on sustainable practices.

Market Growth Projections

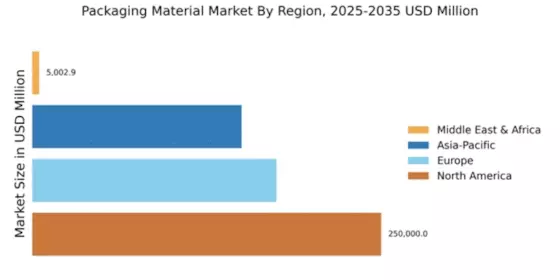

The Global Packaging Material Market Industry is projected to experience substantial growth, with estimates indicating a rise from 625.5 USD Billion in 2024 to 962.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.0% from 2025 to 2035, reflecting the increasing demand for diverse packaging solutions across various sectors. Factors such as sustainability, e-commerce expansion, and technological innovations are likely to drive this growth, creating opportunities for businesses to innovate and adapt to changing market dynamics.

Sustainability Initiatives

The Global Packaging Material Market Industry is increasingly influenced by sustainability initiatives as consumers and businesses alike prioritize eco-friendly practices. Companies are adopting biodegradable and recyclable materials to reduce their environmental footprint. For instance, many brands are transitioning to plant-based plastics and paper products, which are gaining traction in various sectors. This shift not only aligns with consumer preferences but also complies with stringent regulations aimed at reducing plastic waste. As a result, the market is projected to reach 625.5 USD Billion in 2024, reflecting a growing commitment to sustainable packaging solutions.

Technological Advancements

Technological advancements play a crucial role in shaping the Global Packaging Material Market Industry. Innovations in materials science, such as the development of smart packaging, enhance product tracking and consumer engagement. For example, QR codes and NFC technology are increasingly integrated into packaging, allowing consumers to access product information and promotions. Additionally, advancements in manufacturing processes improve efficiency and reduce costs, making sustainable options more accessible. As these technologies evolve, they are expected to contribute to the market's growth, with projections indicating a rise to 962.9 USD Billion by 2035.