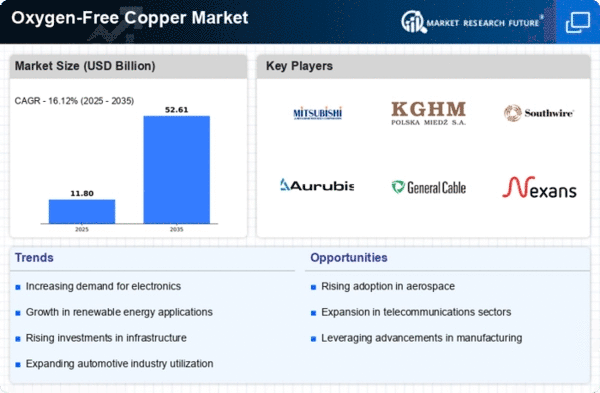

Market Growth Projections

The Global Oxygen-Free Copper Market Industry is projected to experience substantial growth, with estimates indicating a market value of 10.16 USD Billion in 2024 and a potential increase to 52.61 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 16.12% from 2025 to 2035, reflecting the increasing demand across various sectors. The expansion is driven by factors such as technological advancements, rising applications in electronics and automotive industries, and the ongoing shift towards renewable energy solutions. These projections highlight the industry's robust potential and the critical role of oxygen-free copper in supporting global technological advancements.

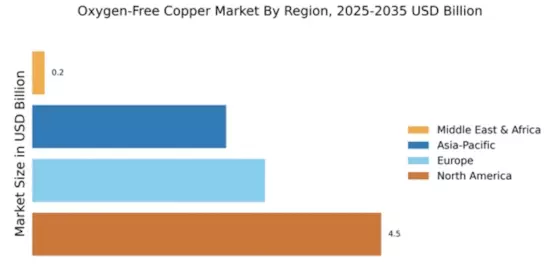

Rising Demand in Electronics

The Global Oxygen-Free Copper Industry experiences a surge in demand driven by the electronics sector. Oxygen-free copper is favored for its superior conductivity and resistance to corrosion, making it ideal for high-performance applications such as connectors, circuit boards, and power cables. As the global electronics market expands, particularly in regions like Asia-Pacific, the need for high-quality materials increases. In 2024, the market is projected to reach 19.6 USD Billion, reflecting the growing reliance on advanced electronic devices. This trend is expected to continue, with the industry adapting to meet the evolving specifications of electronic components.

Growth in Renewable Energy Sector

The Global Oxygen-Free Copper drIndustry is significantly influenced by the expansion of the renewable energy sector. As countries worldwide invest in sustainable energy solutions, the demand for efficient electrical conductors rises. Oxygen-free copper is utilized in solar panels, wind turbines, and energy storage systems due to its excellent electrical properties. This trend aligns with global efforts to transition to greener energy sources, potentially driving the market to reach 43.0 USD Billion by 2035. The increasing adoption of renewable technologies indicates a robust future for oxygen-free copper, as it plays a crucial role in enhancing energy efficiency and reliability.

Increasing Automotive Applications

The Global Oxygen-Free Copper Market Industry is witnessing a notable increase in applications within the automotive sector. With the rise of electric vehicles (EVs) and hybrid technologies, the demand for high-quality conductive materials is paramount. Oxygen-free copper is preferred for its lightweight properties and superior electrical performance, making it ideal for wiring and battery connections in EVs. As the automotive industry shifts towards electrification, the market for oxygen-free copper is expected to expand significantly. This trend aligns with broader global initiatives to reduce carbon emissions and enhance vehicle efficiency, positioning oxygen-free copper as a critical material in the future of automotive design.

Infrastructure Development and Urbanization

The Global Oxygen-Free Copper Market Industry is positively impacted by ongoing infrastructure development and urbanization trends. As cities expand and modernize, the demand for electrical wiring and components increases, particularly in construction and public utilities. Oxygen-free copper's excellent conductivity and durability make it a preferred choice for electrical installations in buildings, transportation systems, and smart city projects. The global push for improved infrastructure is likely to sustain demand for oxygen-free copper, contributing to its market growth. This trend may further enhance the industry's prospects as urbanization continues to drive the need for reliable and efficient electrical solutions.

Technological Advancements in Manufacturing

Technological advancements in the manufacturing processes of oxygen-free copper contribute to the growth of the Global Oxygen-Free Copper Market Industry. Innovations such as continuous casting and improved refining techniques enhance the quality and reduce production costs. These advancements allow manufacturers to produce higher purity copper, which is essential for applications requiring optimal conductivity. As production efficiency improves, the market is likely to benefit from increased supply and reduced prices, fostering wider adoption across various industries. This dynamic could lead to a compound annual growth rate (CAGR) of 7.4% from 2025 to 2035, reflecting the positive impact of technology on market growth.