Consumer Preference for Convenience

In the Over The Counter Healthcare Market, consumer preferences are increasingly leaning towards convenience and accessibility. The modern consumer values the ability to obtain healthcare products without the need for a prescription, which has led to a surge in OTC product sales. Retailers are responding by expanding their OTC product lines and enhancing in-store experiences. Additionally, the rise of e-commerce platforms has made it easier for consumers to purchase OTC products from the comfort of their homes. Recent statistics indicate that online sales of OTC products have seen a significant increase, suggesting that convenience is a key driver in the Over The Counter Healthcare Market.

Health Awareness and Preventive Care

There is a growing trend towards health awareness and preventive care that is shaping the Over The Counter Healthcare Market. Consumers are becoming more educated about health issues and are actively seeking products that promote wellness and prevent illness. This shift is reflected in the increasing sales of vitamins, supplements, and other preventive health products. Market data indicates that the preventive healthcare segment is expanding rapidly, with consumers prioritizing proactive health measures. This trend suggests that the Over The Counter Healthcare Market will continue to evolve, focusing on products that align with consumer desires for health maintenance and disease prevention.

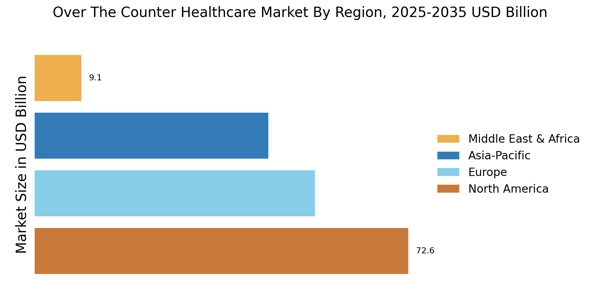

Aging Population and Chronic Conditions

The demographic shift towards an aging population is significantly influencing the Over The Counter Healthcare Market. As individuals age, they often experience a higher prevalence of chronic conditions, necessitating increased healthcare interventions. This demographic trend is projected to result in a substantial rise in demand for OTC products that address common ailments such as pain relief, digestive issues, and cold and flu symptoms. Data suggests that by 2030, nearly 1 in 6 individuals will be aged 65 or older, further amplifying the need for accessible healthcare solutions. Consequently, the Over The Counter Healthcare Market is poised for growth as it adapts to meet the needs of this expanding consumer base.

Regulatory Changes and Market Expansion

Regulatory changes are playing a crucial role in the evolution of the Over The Counter Healthcare Market. Governments are increasingly recognizing the importance of OTC products in public health and are implementing policies that facilitate market access. These changes may include streamlined approval processes for new OTC products and enhanced labeling requirements that improve consumer understanding. As regulations become more favorable, manufacturers are likely to introduce a wider array of products, catering to diverse consumer needs. This regulatory environment is expected to foster innovation and competition within the Over The Counter Healthcare Market, ultimately benefiting consumers.

Technological Advancements in Healthcare

The Over The Counter Healthcare Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as mobile health applications and telemedicine platforms are enhancing consumer access to healthcare information and products. These technologies facilitate informed decision-making, allowing consumers to manage their health more effectively. Furthermore, the integration of artificial intelligence in product recommendations is streamlining the purchasing process. According to recent data, the use of health apps has surged, with millions of downloads recorded annually. This trend indicates a shift towards a more proactive approach to health management, which is likely to drive growth in the Over The Counter Healthcare Market.