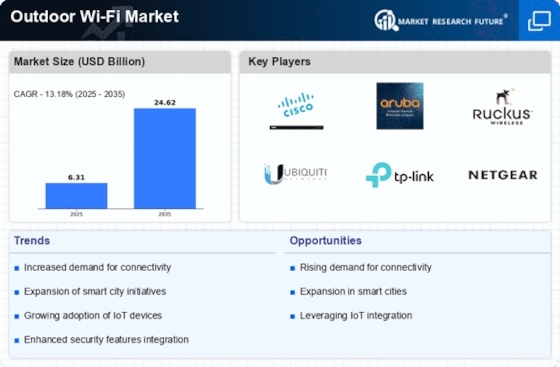

Rising Adoption of IoT Devices

The Outdoor Wi-Fi Market is significantly influenced by the rising adoption of Internet of Things (IoT) devices, which require consistent and reliable internet connectivity. As more devices become interconnected, the demand for outdoor Wi-Fi networks that can support these technologies is expected to grow. IoT applications in outdoor settings, such as smart lighting, environmental monitoring, and public safety systems, necessitate robust Wi-Fi infrastructure. Recent statistics suggest that the number of IoT devices is projected to reach over 30 billion by 2025, indicating a substantial market opportunity for outdoor Wi-Fi providers. This trend highlights the importance of developing scalable and secure outdoor Wi-Fi solutions that can accommodate the increasing number of connected devices in public spaces.

Increasing Demand for Connectivity

The Outdoor Wi-Fi Market experiences a notable surge in demand for connectivity solutions, driven by the proliferation of mobile devices and the increasing reliance on internet access in outdoor environments. As urban areas expand, the need for reliable outdoor Wi-Fi becomes paramount, particularly in public spaces such as parks, squares, and transportation hubs. Recent data indicates that the number of public Wi-Fi hotspots has increased significantly, with estimates suggesting a growth rate of approximately 20% annually. This trend reflects a broader societal shift towards digital engagement, where outdoor Wi-Fi serves as a critical infrastructure component. Consequently, service providers and municipalities are investing in robust outdoor Wi-Fi networks to meet this escalating demand, thereby enhancing user experience and accessibility.

Support for Smart City Developments

The Outdoor Wi-Fi Market is closely intertwined with the evolution of smart city initiatives, which aim to integrate technology into urban planning and infrastructure. As cities strive to enhance efficiency and sustainability, outdoor Wi-Fi networks play a crucial role in facilitating data collection and communication among various smart devices. The implementation of smart traffic management systems, public safety monitoring, and environmental sensors relies heavily on robust outdoor Wi-Fi connectivity. Reports suggest that cities investing in smart technologies are likely to see a return on investment through improved public services and reduced operational costs. This alignment with smart city goals not only drives the demand for outdoor Wi-Fi but also positions it as a foundational element in the development of future urban landscapes.

Growth of Outdoor Events and Activities

The Outdoor Wi-Fi Market benefits from the increasing prevalence of outdoor events and activities, which require reliable internet access for both organizers and attendees. Festivals, concerts, and sporting events are increasingly incorporating Wi-Fi solutions to enhance the experience for participants and facilitate real-time communication. Data indicates that the outdoor events sector has expanded, with a projected growth rate of 15% over the next few years. This trend underscores the necessity for event organizers to provide seamless connectivity, enabling live streaming, social media engagement, and mobile app usage. As a result, the demand for temporary and permanent outdoor Wi-Fi installations is likely to rise, prompting service providers to innovate and offer tailored solutions for diverse event settings.

Enhanced Focus on Public Safety and Security

The Outdoor Wi-Fi Market is increasingly shaped by the heightened focus on public safety and security measures in urban environments. As cities prioritize the safety of their residents, outdoor Wi-Fi networks are being integrated with surveillance systems and emergency response technologies. This integration allows for real-time monitoring and rapid communication during emergencies, thereby enhancing public safety. Data suggests that municipalities are allocating more resources towards smart surveillance and emergency response systems, which often rely on outdoor Wi-Fi connectivity. This trend not only drives the demand for outdoor Wi-Fi solutions but also emphasizes the need for secure and resilient networks that can withstand potential threats. Consequently, service providers are likely to innovate in security protocols and infrastructure to meet these evolving demands.