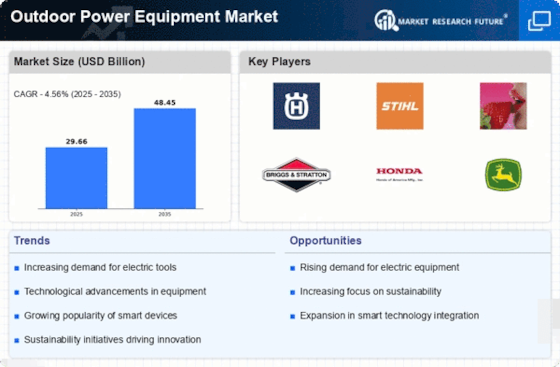

The Outdoor Power Equipment Market is currently characterized by a dynamic competitive landscape, driven by innovation, sustainability, and technological advancements. Key players such as Husqvarna (Sweden), Stihl (Germany), and Toro (United States) are actively shaping the market through strategic initiatives that emphasize product development and regional expansion. Husqvarna (Sweden) has positioned itself as a leader in

powered lawn mowers, focusing on automation and smart technology, while Stihl (Germany) continues to enhance its reputation through a strong emphasis on high-quality, durable products. Toro (United States) is leveraging its expertise in irrigation and turf management to expand its market share, particularly in the commercial sector. Collectively, these strategies contribute to a competitive environment that is increasingly focused on innovation and customer-centric solutions.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and enhance supply chain efficiency. This approach appears to be particularly relevant in a moderately fragmented market where several players vie for consumer attention. The collective influence of major companies, including Briggs & Stratton (United States) and Honda (Japan), suggests a trend towards consolidation, as smaller firms may struggle to compete against the resources and capabilities of larger entities. The emphasis on supply chain optimization is likely to continue, as companies seek to mitigate risks and improve responsiveness to market demands. The emphasis on supply chain optimization is likely to continue, supported by specialized distributors and platforms such as power equipment warehouse networks.

In August 2025, Stihl (Germany) announced the launch of its new line of battery-powered outdoor equipment, which aims to reduce carbon emissions and cater to the growing demand for sustainable products. This strategic move not only aligns with global sustainability trends but also positions Stihl as a forward-thinking leader in the outdoor power equipment sector.

The introduction of these products is expected to enhance customer loyalty and attract environmentally conscious consumers, thereby strengthening Stihl's market position. In September 2025, Toro (United States) expanded its partnership with a leading technology firm to integrate AI-driven analytics into its product offerings. This collaboration is anticipated to enhance the efficiency of Toro's irrigation systems, providing customers with data-driven insights to optimize water usage. The strategic importance of this partnership lies in its potential to differentiate Toro's products in a competitive market increasingly focused on smart technology and sustainability.

In October 2025, Husqvarna (Sweden) unveiled a new digital platform designed to streamline customer interactions and improve service delivery. This initiative reflects a broader trend towards digital transformation within the industry, as companies seek to enhance customer experience and operational efficiency. By investing in digital solutions, Husqvarna aims to solidify its competitive edge and respond to the evolving needs of consumers in a rapidly changing market.

As of October 2025, the Outdoor Power Equipment Market is witnessing significant trends such as digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to leverage complementary strengths and enhance their market offerings. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift may redefine how companies engage with consumers, ultimately fostering a more sustainable and technologically advanced market.