Research Methodology on Fluid Power Equipment Market

The research methodology used to conduct the research study of the global Fluid Power Equipment Market, published by Market Research Future (MRFR), includes a combination of primary and secondary research structures. The insights into the market are based on both primary and secondary data sources. Primary data sources comprise experts in the industry from both supply and demand sides, and secondary data sources include company websites, databases, directories, white papers, magazines, books, and industry-specific journals. The secondary data sources help researchers and analysts to gain an overall view of the industry and its underlying dynamics. This industry-specific data is also further scrutinized and validated through qualitative and quantitative analysis to accomplish better insights.

Market sizing and structure

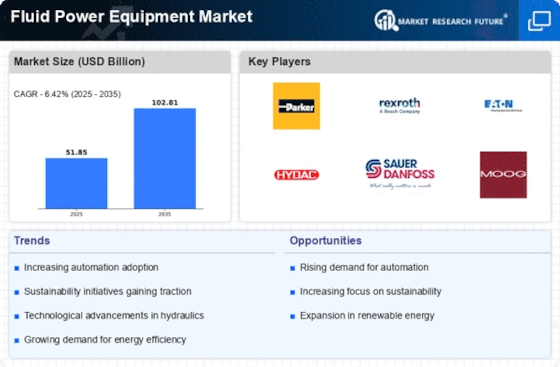

To assess the size of the current market and the growth in the future, different surveys are conducted of the key players in the fluid power equipment industry. The data is collected through primary interviews, secondary sources, and published reports and guides. The surveys are executed in a structured manner to gain accurate information on different factors driving the market. Both quantitative and qualitative information is collected to estimate the market size. The study includes the analysis of all important market segments, along with a macro and microeconomic outlook.

Geographical analysis

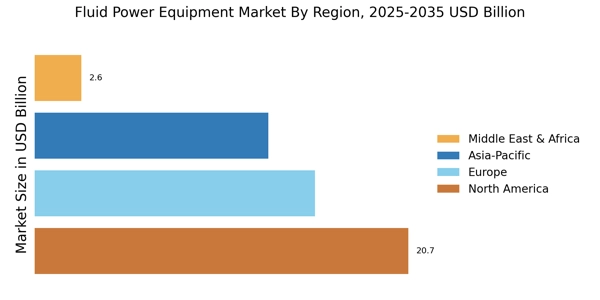

The geographical analysis covers the analysis of key geographic markets, such as North America, Europe, Asia Pacific, the Middle East and Africa and South America. The analysis examined different aspects of the market, such as historical trends, present conditions, and future prospects. The analysis also covered market segmentation as per the end-use industries and the major end-users.

Competitive landscape

The competitive landscape is studied in detail in the report to understand the strategies adopted by leading players in the global fluid power equipment market. The analytical assessment of the market included key players such as Eaton, Parker Hannifin Corp., and Tectra Automation, among others.

Research objectives

The research objectives are developed to understand the key areas to be studied in terms of market sizing, geography, and market structure. The objectives include studying historical trends, present growth opportunities, and future prospects. Moreover, the analysis also looked at the regional market and segmentation.

Data triangulation

To verify the data collected and to extract the true potential of the market, data triangulation is carried out. This process includes collecting data from both primary and secondary sources and analyzing it from a different angle to gain an in-depth understanding of the market.

Research validity

The research published by MRFR is rigorously validated by industry experts and market analysts for validity and reliability. The research is validated through various methods, such as stakeholder analysis, primary interviews with industry veterans, and surveys among various industry experts. The market estimations are further cross-checked with several industry veterans to ensure accuracy. All data and information are further tested to ensure accuracy.