Market Trends

Key Emerging Trends in the Orthopedic Trauma Devices Market

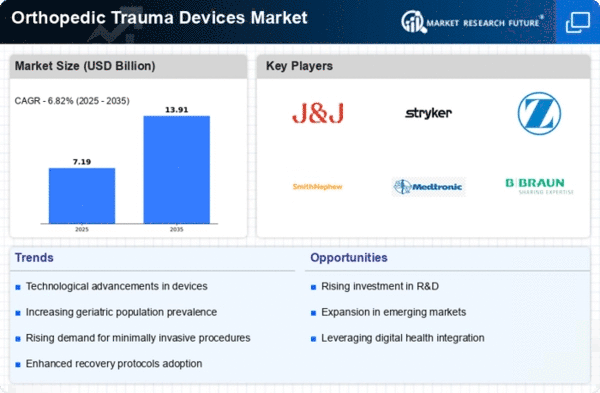

For years now Orthopedic Trauma Devices Market has experienced notable trends that reflect changes in healthcare landscape as well technological advancements in its field. Minimally invasive techniques are a key trend toward quick recovery and less postoperative complications preferred by patients and physicians alike Patients Minimally invasive procedures not only allow patients to return back in their natural activities sooner but also align with industry-wide movement towards less invasive approaches.

Another trend shaping up this market is increased incidence of cases related to orthopedic trauma resulting from factors inclusive of increased road accidents as well as sport related injuries and falls especially in the aged population. An older demographic coupled with higher levels of activity among seniors has resulted in orthopedic trauma spike thus necessitating modern devices and technologies for effective treatment. This development has pushed manufacturers to come up with innovative orthopedic trauma devices that are applicable in a broad range of fractures and injuries.

The market is also driven by innovation in materials and design. They involve using advanced materials like titanium and bioresorbable polymers to enhance strength, durability and biocompatibility of orthopedic trauma devices. For one, these materials go beyond offering structural support to eliminate the chances of unwanted reactions or infections occurring. Besides, orthopedic trauma implants have become highly individualized through 3D printing that has led to personalized solutions fitting unique anatomies. Another leading orthopedic trauma products development is the adoption of digital technologies and smart implants. Orthopedic implants that integrate sensors and connectivity features enable real-time monitoring of healing processes hence promoting remote patient monitoring by healthcare professionals. This trend aligns with the broader digital health movement emphasizing data driven health solutions for better patient outcomes. Their rise is further propelled by the existence of affordable substitutions as well as market based on quality health care. Health systems globally are under increasing pressure to reduce costs while maintaining the standards of care. Consequently, there is a growing demand for low cost orthopedic trauma solutions that yield best outcomes. This has led to emergence of cheap but good quality implants thereby increasing their access among many patients.

Leave a Comment