Market Share

Orthopedic Trauma Devices Market Share Analysis

The orthopedic trauma devices market is a critical sector of the healthcare industry that employs various strategies for market share positioning to negotiate the competitive landscape and meet different needs of patients and health care providers. Some companies opt for product differentiation as their main strategy; they do this by focusing on producing specialized, cutting-edge trauma products. These may include trauma devices made from sophisticated materials with improved designs or enhanced functionality thereby distinguishing them in the market. This tactic attracts not only orthopedic surgeons looking for cutting-edge solutions but also allows firms to command premium prices for their specialized devices as well. It is a strategy that promotes a reputation for delivering state-of-the-art trauma services.

Another key strategy adopted in the Orthopedic Trauma Devices Market is cost leadership. Companies endeavor to become low-cost suppliers of trauma devices without compromising quality and effectiveness. This approach works best in cost-sensitive markets such as healthcare institutions under financial constraints. By improving manufacturing processes, managing supply chains and benefiting from economies of scale, manufacturers can provide affordable yet dependable trauma devices. Additionally, this policy helps address budgetary limitations faced by healthcare providers while also providing an avenue into developing markets where affordability is key.

Market segmentation emerges as one of the vital tactics whereby companies produce trauma devices specifically designed for certain orthopedic segments or applications. Multiple fractures within distinct body parts may necessitate different types of trauma devices hence customization ensures each device addresses unique demands from targeted patient groups. With this type of focus, businesses can position themselves perfectly with respect to what orthopedic doctors and hospitals are seeking hence creating competitive advantage against competitors in that line of operation. Furthermore, specialization in particular areas within orthopedics makes companies leaders in specific market sectors, which builds confidence among their target audience.

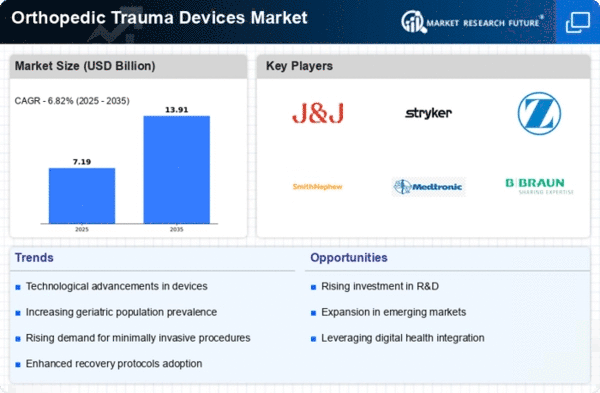

Continuous innovation remains a cornerstone for success in the Orthopedic Trauma Devices Market because it calls for investing heavily into R&D activities, keeping up with technology trends and adjusting products accordingly so as to retain market share. The use of bioresorbable polymers, more efficient manufacturing techniques and smart technologies are some of the moves that help in transforming trauma devices. This is a way for manufacturers to stay ahead of their rivals thereby providing surgeons with machines used to enhance patient outcomes.

Leave a Comment