Rise in Minimally Invasive Procedures

The trend towards minimally invasive procedures is significantly influencing the Orthopedic Power Tool Market. Surgeons are increasingly opting for techniques that reduce patient trauma and expedite recovery. This shift is driven by the growing awareness of the benefits associated with minimally invasive surgeries, such as reduced scarring and shorter hospital stays. According to recent data, the market for minimally invasive orthopedic surgeries is anticipated to expand at a rate of 7% annually. As a result, orthopedic power tools designed specifically for these procedures are in high demand. Manufacturers are responding by developing specialized tools that cater to the unique requirements of minimally invasive techniques. This trend not only enhances patient outcomes but also drives the growth of the orthopedic power tool market, as healthcare providers seek to adopt the latest innovations to improve surgical efficacy.

Aging Population and Orthopedic Conditions

The increasing prevalence of orthopedic conditions among the aging population is a critical driver for the Orthopedic Power Tool Market. As individuals age, they are more susceptible to conditions such as arthritis, osteoporosis, and fractures, necessitating surgical interventions. The World Health Organization projects that the number of people aged 60 and older will double by 2050, leading to a higher demand for orthopedic surgeries. This demographic shift is expected to propel the orthopedic power tool market, with an estimated growth rate of 5.8% over the next several years. Healthcare systems are adapting to this trend by investing in advanced orthopedic power tools to address the needs of older patients. Consequently, the industry is likely to see an increase in the development and adoption of tools that cater specifically to the requirements of geriatric orthopedic care.

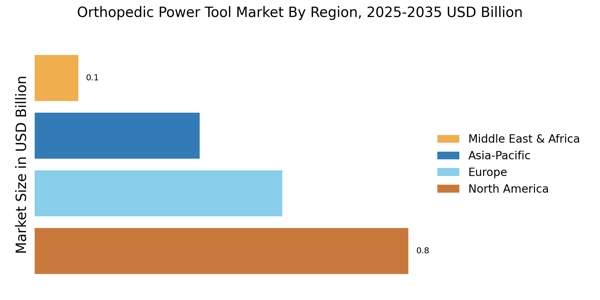

Increased Investment in Healthcare Infrastructure

The Orthopedic Power Tool Market is benefiting from increased investment in healthcare infrastructure across various regions. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in developing regions. This investment is aimed at improving surgical capabilities and expanding access to advanced medical technologies. As a result, the demand for orthopedic power tools is expected to rise, with a projected market growth of 6% annually. Enhanced healthcare infrastructure not only facilitates the adoption of innovative surgical tools but also ensures that healthcare providers are equipped to perform complex orthopedic procedures. This trend is likely to create a favorable environment for the orthopedic power tool market, as hospitals and surgical centers seek to upgrade their equipment to meet the growing needs of patients.

Rising Awareness and Demand for Orthopedic Surgeries

The growing awareness and demand for orthopedic surgeries are pivotal factors driving the Orthopedic Power Tool Market. Patients are increasingly informed about treatment options for orthopedic conditions, leading to a rise in elective surgeries. This trend is supported by educational campaigns and advancements in surgical techniques that highlight the benefits of timely interventions. Market analysis indicates that the demand for orthopedic surgeries is expected to grow at a rate of 6.2% annually. As more patients seek surgical solutions for their orthopedic issues, healthcare providers are compelled to invest in advanced orthopedic power tools to meet this demand. This heightened awareness not only boosts the market for orthopedic power tools but also encourages manufacturers to innovate and improve their product offerings, ensuring that they align with the evolving needs of both surgeons and patients.

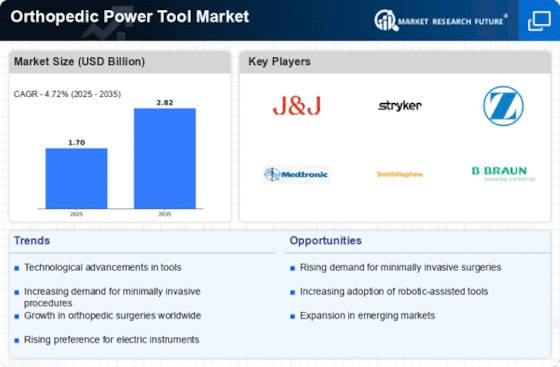

Technological Advancements in Orthopedic Power Tools

The Orthopedic Power Tool Market is experiencing a surge in technological advancements that enhance surgical precision and efficiency. Innovations such as battery-operated tools, improved ergonomics, and advanced imaging technologies are transforming surgical practices. For instance, the integration of robotics and artificial intelligence into orthopedic power tools is likely to improve outcomes and reduce recovery times. The market is projected to grow at a compound annual growth rate of approximately 6.5% over the next few years, driven by these advancements. Surgeons are increasingly adopting these technologies, which not only streamline procedures but also minimize the risk of complications. As hospitals and surgical centers invest in state-of-the-art equipment, the demand for advanced orthopedic power tools is expected to rise, indicating a robust growth trajectory for the industry.