Increased DIY Culture

The Electric Power Tool Market is witnessing a notable increase in the DIY culture, which is reshaping consumer behavior and driving sales. As more individuals engage in home improvement projects, the demand for electric power tools is on the rise. This trend is particularly evident among millennials and Gen Z, who are more inclined to undertake DIY tasks. Market data suggests that the DIY segment is expected to account for approximately 30% of total sales in the electric power tool market by 2025. Retailers are responding by offering a wider range of tools tailored for home users, thereby expanding their customer base and enhancing market penetration.

Technological Advancements

The Electric Power Tool Market is experiencing a surge in technological advancements, which is driving demand for more efficient and user-friendly tools. Innovations such as brushless motors, lithium-ion batteries, and smart connectivity features are enhancing performance and usability. For instance, the integration of IoT technology allows for real-time monitoring and diagnostics, which can improve maintenance and reduce downtime. As a result, manufacturers are increasingly focusing on R&D to develop tools that not only meet but exceed consumer expectations. This trend is reflected in the projected growth of the market, which is expected to reach USD 40 billion by 2026, indicating a robust demand for advanced electric power tools.

Growing E-commerce Platforms

The Electric Power Tool Market is benefiting from the rapid growth of e-commerce platforms, which are transforming the way consumers purchase tools. Online shopping offers convenience and a broader selection of products, allowing consumers to compare prices and features easily. This shift is particularly advantageous for niche brands that may not have a strong presence in physical retail stores. Recent statistics indicate that e-commerce sales in the power tool sector have increased by over 25% in the past year, highlighting a significant shift in consumer purchasing habits. As a result, manufacturers are increasingly investing in online marketing strategies to reach a wider audience and boost sales.

Focus on Safety and Ergonomics

The Electric Power Tool Market is increasingly prioritizing safety and ergonomics in tool design, which is becoming a key driver of market growth. As awareness of workplace safety rises, consumers are seeking tools that not only enhance productivity but also minimize the risk of injury. Features such as anti-vibration technology, safety guards, and ergonomic handles are becoming standard in new product lines. This focus on safety is reflected in market trends, with tools designed for comfort and ease of use gaining popularity among both professionals and DIY enthusiasts. Manufacturers are likely to continue innovating in this area, as consumer demand for safer tools is expected to grow.

Rising Construction Activities

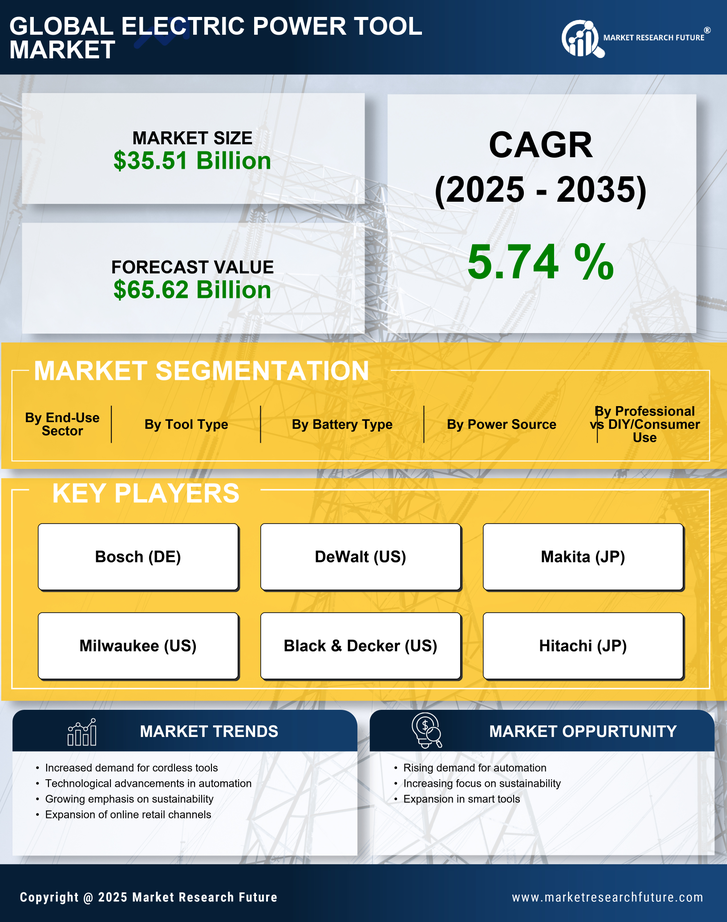

The Electric Power Tool Market is significantly influenced by the rising construction activities across various sectors. As urbanization continues to accelerate, the demand for residential and commercial buildings is increasing, leading to a higher requirement for power tools. In particular, the construction sector is projected to grow at a CAGR of 5.5% over the next five years, which directly correlates with the demand for electric power tools. This growth is further fueled by government initiatives aimed at infrastructure development, which are likely to create a favorable environment for the electric power tool market. Consequently, manufacturers are expanding their product lines to cater to the evolving needs of construction professionals.