Increasing Pest Resistance

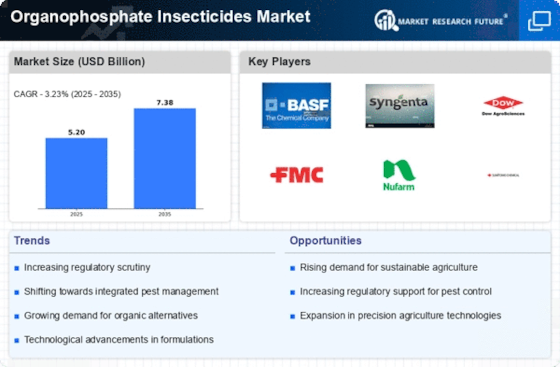

The rising incidence of pest resistance to conventional insecticides is a critical driver for the organophosphate insecticides Market. As pests evolve and develop resistance, the need for more effective pest control solutions becomes apparent. Organophosphate insecticides, known for their mode of action, are often employed as a solution to combat resistant pest populations. Market data suggests that the demand for these insecticides is likely to increase as farmers seek alternatives to maintain crop yields. This trend underscores the importance of organophosphate insecticides in integrated pest management strategies, positioning the Organophosphate Insecticides Market for sustained growth in the face of evolving agricultural challenges.

Rising Demand for Food Security

The increasing global population has led to a heightened demand for food security, which in turn drives the Organophosphate Insecticides Market. As agricultural productivity becomes paramount, farmers are increasingly relying on effective pest control solutions to safeguard their crops. The market for organophosphate insecticides is projected to grow as these chemicals are known for their efficacy in controlling a wide range of pests. According to recent data, the agricultural sector is expected to expand, necessitating the use of organophosphate insecticides to enhance yield and quality. This trend indicates a robust growth trajectory for the Organophosphate Insecticides Market, as stakeholders seek reliable solutions to meet the food demands of a burgeoning population.

Technological Advancements in Agriculture

Technological advancements in agriculture are significantly influencing the Organophosphate Insecticides Market. Innovations such as precision agriculture and biotechnology are enabling farmers to apply insecticides more efficiently, thereby maximizing their effectiveness while minimizing environmental impact. The integration of data analytics and remote sensing technologies allows for targeted application, which is likely to enhance the performance of organophosphate insecticides. As these technologies become more accessible, the market is expected to witness an increase in the adoption of organophosphate products. This shift not only improves pest management strategies but also aligns with sustainable agricultural practices, further propelling the Organophosphate Insecticides Market.

Growing Awareness of Sustainable Agriculture

The growing awareness of sustainable agriculture practices is influencing the Organophosphate Insecticides Market. As consumers become more conscious of food production methods, there is a push for pest control solutions that are both effective and environmentally responsible. Organophosphate insecticides, when used judiciously, can play a role in sustainable pest management by reducing crop losses and improving yields. Market trends indicate that farmers are increasingly adopting integrated pest management strategies that incorporate organophosphate products as part of a broader approach to sustainability. This shift towards responsible agricultural practices is likely to enhance the reputation and demand for the Organophosphate Insecticides Market.

Regulatory Support for Crop Protection Products

Regulatory frameworks that support the use of crop protection products are essential for the Organophosphate Insecticides Market. Governments and agricultural bodies are increasingly recognizing the need for effective pest control to ensure food security. As a result, there is a trend towards the approval and registration of organophosphate insecticides that meet safety and efficacy standards. This regulatory support not only facilitates market entry for new products but also encourages innovation within the industry. The alignment of regulatory policies with agricultural needs is likely to bolster the Organophosphate Insecticides Market, as stakeholders seek compliant solutions to enhance agricultural productivity.