Consumer Electronics Market Expansion

The expansion of the consumer electronics market is significantly influencing the Organic OLED Market. As consumer preferences shift towards high-quality visual experiences, OLED technology is increasingly being adopted in televisions, smartphones, and other electronic devices. Recent market analysis suggests that the OLED TV segment alone is expected to reach a valuation of several billion dollars by 2026, reflecting a robust growth trajectory. This expansion is fueled by the demand for larger screens with enhanced color accuracy and contrast ratios, which OLED displays are well-equipped to provide. Consequently, the growth of the consumer electronics market is likely to bolster the Organic OLED Market, as manufacturers strive to meet the evolving demands of tech-savvy consumers.

Advancements in Manufacturing Techniques

Innovations in manufacturing techniques are playing a pivotal role in the Organic OLED Market. Recent developments in production processes, such as inkjet printing and roll-to-roll manufacturing, have the potential to reduce costs and improve the scalability of OLED technology. These advancements enable manufacturers to produce OLED panels more efficiently, thereby lowering the overall production costs. For instance, the cost of OLED panel production has decreased significantly over the past few years, making it more accessible for various applications. As these manufacturing techniques continue to evolve, they are likely to enhance the competitiveness of organic OLEDs against other display technologies, further propelling the growth of the Organic OLED Market.

Increasing Adoption in Automotive Displays

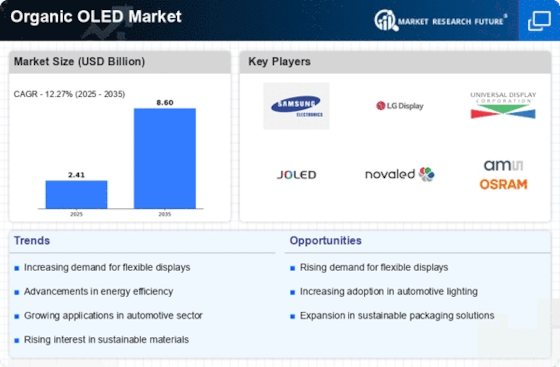

The integration of organic OLED technology in automotive displays is emerging as a key driver for the Organic OLED Market. With the automotive sector increasingly focusing on enhancing user experience and aesthetic appeal, OLED displays offer superior image quality, flexibility, and design possibilities. Recent statistics indicate that the automotive OLED display market is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is attributed to the rising demand for advanced driver-assistance systems and infotainment displays that utilize OLED technology. As automotive manufacturers continue to adopt organic OLEDs for their vehicles, the Organic OLED Market is expected to expand significantly, driven by this trend.

Rising Demand for Energy-Efficient Displays

The Organic OLED Market is experiencing a notable surge in demand for energy-efficient display technologies. As consumers and manufacturers alike become increasingly aware of energy consumption and its environmental impact, OLED displays, known for their low power requirements, are gaining traction. According to recent data, OLED displays consume up to 30% less energy compared to traditional LCDs, making them an attractive option for various applications, including smartphones, televisions, and wearables. This shift towards energy efficiency is not merely a trend but appears to be a fundamental change in consumer preferences, driving manufacturers to innovate and invest in organic OLED technologies. Consequently, the Organic OLED Market is likely to witness substantial growth as energy-efficient solutions become a priority for both consumers and businesses.

Government Initiatives Supporting Sustainable Technologies

Government initiatives aimed at promoting sustainable technologies are emerging as a significant driver for the Organic OLED Market. Various countries are implementing policies and incentives to encourage the adoption of energy-efficient and environmentally friendly technologies, including organic OLED displays. These initiatives often include funding for research and development, tax incentives for manufacturers, and regulations that favor sustainable practices. As governments worldwide prioritize sustainability in their agendas, the Organic OLED Market is likely to benefit from increased support and investment. This alignment with governmental policies not only enhances the market's growth potential but also positions organic OLED technology as a viable solution in the quest for sustainable development.