Organic Drinks Size

Organic Drinks Market Growth Projections and Opportunities

The organic drinks market is influenced by a multitude of factors that collectively shape its dynamics and growth patterns. One of the pivotal drivers is the increasing consumer awareness and preference for healthier beverage options. As individuals become more conscious of the potential health risks associated with artificial additives, sweeteners, and preservatives in conventional drinks, there is a growing demand for organic alternatives. Consumers are drawn to organic drinks for their perceived health benefits, including the absence of synthetic chemicals and a focus on natural, high-quality ingredients.

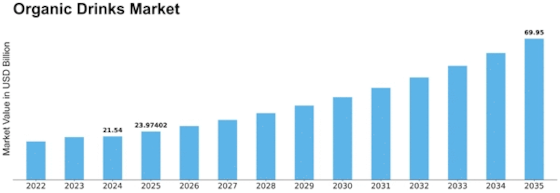

Regulatory factors play a significant role in shaping the landscape of the organic drinks market. Governments worldwide are implementing stringent regulations and certification standards to ensure the authenticity and quality of organic products. Certification bodies such as the USDA Organic and European Organic Certification play a crucial role in building consumer trust. Compliance with these standards not only serves as a quality assurance measure but also acts as a market differentiator, allowing certified organic drinks to stand out in a crowded marketplace. As per the most recent research report, the Organic Drinks Market is anticipated to exhibit substantial growth at a rate of 13.00% from 2023 to 2032, ultimately reaching a market size of USD 50.76 billion by the conclusion of 2032. The increasing popularity of organic drinks on a global scale is attributed to their numerous health benefits, driving consumers to gravitate towards these beverages. There is a growing consumer preference for organic and natural teas and coffees, contributing significantly to the surge in demand for organic drinks. This heightened consumer inclination towards organically labeled products extends beyond just beverages, as individuals are increasingly opting for organic choices even when purchasing fruits and vegetables. The market research underscores the rising consumer awareness and preference for organic options in the realm of beverages and food products. Economic factors, particularly rising disposable incomes, contribute to the growth of the organic drinks market. As consumers have more spending power, they are increasingly willing to invest in premium and healthier beverage options. The perception that organic drinks are a worthwhile investment in personal well-being has led to a willingness to pay a premium for these products. However, companies in the organic drinks market need to navigate the balance between offering high-quality organic beverages and maintaining competitive pricing to cater to a broader consumer base.

Technological advancements in food and beverage production also play a role in shaping the organic drinks market. Innovations in processing techniques, packaging, and distribution contribute to the overall efficiency of organic drink production. Additionally, advancements in organic farming practices and sustainable agriculture techniques impact the availability and cost of organic ingredients, influencing the market dynamics.

Consumer preferences and trends significantly impact the product offerings within the organic drinks market. Manufacturers respond to the demand for diverse flavors, functional benefits, and novel ingredient combinations. Organic drinks encompass a wide range of beverages, including organic juices, teas, energy drinks, and plant-based milk alternatives. Brands that can align their product portfolios with evolving consumer preferences are better positioned to capture market share and maintain consumer loyalty.

Sustainability and environmental considerations are increasingly influencing the organic drinks market. Consumers are not only seeking healthier beverage options but also showing a preference for products that adhere to sustainable and eco-friendly practices. Companies that emphasize environmentally conscious sourcing, production, and packaging can gain a competitive edge, resonating with consumers who prioritize sustainability in their purchasing decisions.

Global trends, such as the rise of plant-based diets and the emphasis on clean labels, intersect with the organic drinks market. Plant-based organic beverages, free from artificial additives and preservatives, appeal to consumers looking for natural and ethical choices. The alignment of organic drinks with broader lifestyle trends positions the market for sustained growth, reflecting the evolving consumer consciousness in the beverage sector.

Leave a Comment