Rising Healthcare Expenditure

The increase in healthcare expenditure across various regions is a significant driver for the Oral Anti-Diabetic Drug Market. As governments and private sectors allocate more resources to healthcare, there is a corresponding rise in the availability and accessibility of diabetes treatments. This trend is particularly evident in developed economies, where healthcare budgets are expanding to accommodate the growing burden of chronic diseases like diabetes. Consequently, the Oral Anti-Diabetic Drug Market is poised for growth as more patients gain access to essential medications. Additionally, the emphasis on preventive care and early intervention may further enhance the demand for oral anti-diabetic drugs.

Growing Awareness and Education

The increasing awareness and education surrounding diabetes management are pivotal factors driving the Oral Anti-Diabetic Drug Market. Public health campaigns and educational initiatives have significantly improved the understanding of diabetes and its treatment options among patients and healthcare providers. This heightened awareness is likely to lead to earlier diagnosis and more proactive management of the disease, resulting in increased prescriptions for oral anti-diabetic medications. As patients become more informed about their treatment options, the demand for effective oral therapies is expected to rise, thereby contributing to the growth of the Oral Anti-Diabetic Drug Market.

Regulatory Support and Approvals

Regulatory support and streamlined approval processes for new oral anti-diabetic drugs are essential drivers of the Oral Anti-Diabetic Drug Market. Regulatory agencies are increasingly recognizing the need for innovative therapies to address the diabetes epidemic, leading to expedited review processes for promising new medications. This supportive regulatory environment encourages pharmaceutical companies to invest in research and development, ultimately resulting in a wider array of treatment options for patients. As new drugs receive approval and enter the market, the Oral Anti-Diabetic Drug Market is likely to experience significant growth, driven by the introduction of novel therapies that meet the evolving needs of diabetes management.

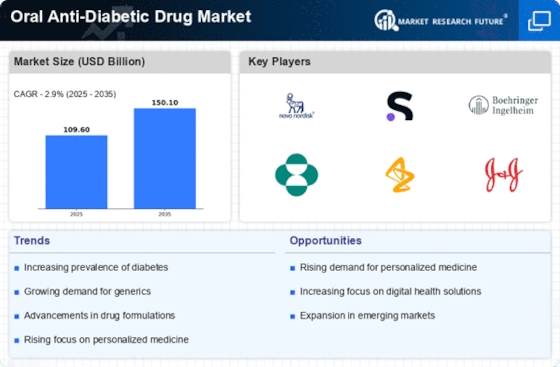

Advancements in Drug Formulations

Innovations in drug formulations are playing a crucial role in shaping the Oral Anti-Diabetic Drug Market. Recent developments in the formulation of oral anti-diabetic agents have led to improved efficacy, safety, and patient compliance. For instance, the introduction of once-daily dosing regimens and combination therapies has enhanced the therapeutic options available to patients. These advancements not only improve patient outcomes but also contribute to the overall growth of the market. The Oral Anti-Diabetic Drug Market is likely to benefit from ongoing research and development efforts aimed at creating more effective and user-friendly medications, thereby attracting a broader patient base.

Increasing Prevalence of Diabetes

The rising incidence of diabetes worldwide is a primary driver for the Oral Anti-Diabetic Drug Market. According to recent statistics, the number of individuals diagnosed with diabetes has surged, with estimates suggesting that over 500 million people are currently living with the condition. This alarming trend is likely to propel the demand for effective oral anti-diabetic medications, as healthcare systems strive to manage this chronic disease. The Oral Anti-Diabetic Drug Market is expected to expand significantly as pharmaceutical companies develop innovative therapies to address the needs of this growing patient population. Furthermore, the increasing awareness of diabetes management and the importance of medication adherence may further stimulate market growth.