Rising Demand in Robotics

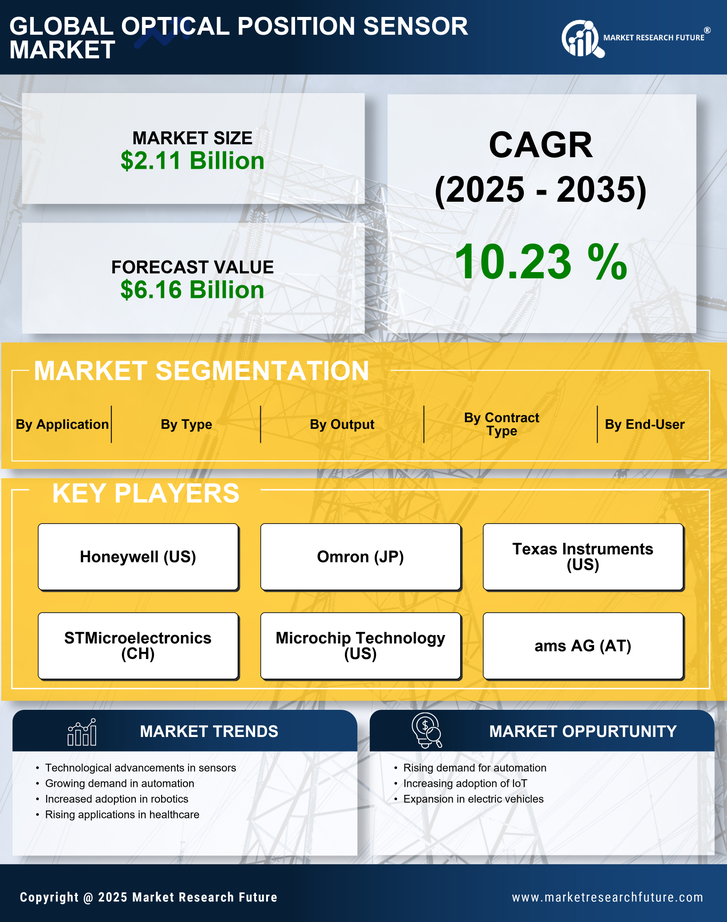

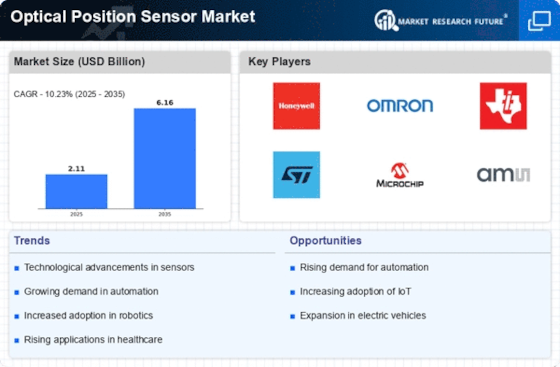

The Optical Position Sensor Market is experiencing a notable surge in demand due to the increasing integration of optical sensors in robotics applications. As industries adopt automation, the need for precise positioning and movement tracking becomes paramount. According to recent data, the robotics sector is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is likely to drive the adoption of optical position sensors, which offer high accuracy and reliability. Furthermore, advancements in sensor technology are enabling the development of more sophisticated robotic systems, which in turn fuels the demand for optical position sensors. The Optical Position Sensor Market is thus positioned to benefit significantly from this trend, as manufacturers seek to enhance the capabilities of their robotic solutions.

Growth in Consumer Electronics

The Optical Position Sensor Market is benefiting from the growth in consumer electronics, where the demand for precise positioning and touchless control is escalating. Devices such as smartphones, tablets, and smart home appliances increasingly incorporate optical position sensors to enhance user experience and functionality. Market analysis suggests that the consumer electronics segment is expected to grow at a rate of around 10% annually, driven by the rising trend of smart devices. This growth indicates a robust opportunity for the Optical Position Sensor Market, as manufacturers strive to integrate advanced sensing technologies into their products to meet consumer expectations for innovation and performance.

Expansion in Automotive Applications

The Optical Position Sensor Market is witnessing substantial growth driven by the expansion of automotive applications. With the automotive sector increasingly focusing on advanced driver-assistance systems (ADAS) and autonomous vehicles, the demand for precise positioning sensors is on the rise. Optical position sensors are integral to various automotive functions, including steering, braking, and throttle control. Market data indicates that the automotive segment is expected to account for a significant share of the optical position sensor market, with a projected growth rate of approximately 15% annually. This trend suggests that as vehicles become more automated and connected, the reliance on optical position sensors will intensify, thereby propelling the Optical Position Sensor Market forward.

Increased Focus on Industrial Automation

The Optical Position Sensor Market is significantly influenced by the increased focus on industrial automation across various sectors. As manufacturers seek to enhance productivity and reduce operational costs, the adoption of automation technologies is becoming more prevalent. Optical position sensors are essential for ensuring accurate positioning in automated systems, which include assembly lines and material handling equipment. Recent statistics indicate that the industrial automation market is projected to grow at a compound annual growth rate of approximately 12%. This trend suggests that the Optical Position Sensor Market will likely experience substantial growth as industries invest in automation solutions that require reliable and precise positioning capabilities.

Technological Advancements in Sensor Design

Technological advancements in sensor design are playing a crucial role in shaping the Optical Position Sensor Market. Innovations such as improved light source technologies and enhanced signal processing algorithms are leading to the development of more efficient and accurate optical position sensors. These advancements not only improve performance but also reduce the size and cost of sensors, making them more accessible to a wider range of applications. As industries seek to optimize their operations, the demand for high-performance optical position sensors is likely to increase. The Optical Position Sensor Market stands to gain from these technological improvements, as they enable manufacturers to offer more competitive products that meet the evolving needs of various sectors.