Market Analysis

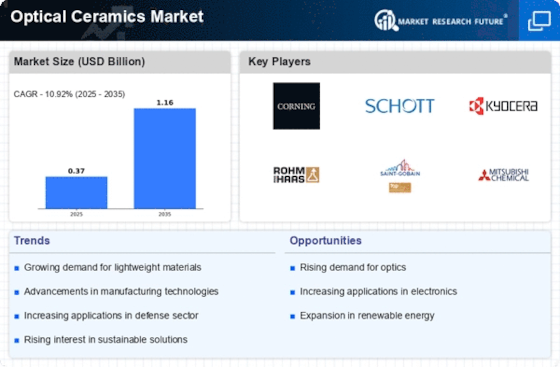

Optical Ceramics market (Global, 2024)

Introduction

The Optical Ceramics market is poised to play a pivotal role in the advancement of various high-tech applications, driven by the increasing demand for materials that offer superior optical properties and durability. As industries such as telecommunications, defense, and consumer electronics continue to evolve, the need for innovative solutions that can withstand extreme conditions while providing exceptional performance is more critical than ever. Optical ceramics, known for their unique characteristics such as high transparency, low scattering, and resistance to thermal shock, are becoming essential components in the development of advanced optical systems. This market analysis delves into the key trends, technological advancements, and competitive landscape shaping the future of optical ceramics, highlighting the opportunities and challenges that stakeholders may encounter in this dynamic environment.

PESTLE Analysis

- Political

- In 2024, the Optical Ceramics market is influenced by various political factors, including government policies on manufacturing and trade. For instance, the U.S. government has allocated approximately $1.5 billion to support advanced manufacturing technologies, which includes optical materials. Additionally, trade agreements such as the USMCA have implications for the import and export of optical ceramics, affecting supply chains and market accessibility. Countries like China and Germany are also implementing policies to enhance their domestic production capabilities, which could impact global competition.

- Economic

- The economic landscape for the Optical Ceramics market in 2024 is shaped by fluctuations in raw material costs and consumer demand. The price of alumina, a key raw material for optical ceramics, has seen an increase of about 12% in the past year, reaching approximately $1,200 per ton. Furthermore, the global economic recovery post-pandemic has led to a projected increase in consumer electronics sales by 8%, driving demand for optical components. This economic environment is crucial for manufacturers as they navigate cost pressures while trying to meet rising demand.

- Social

- Social trends in 2024 indicate a growing consumer preference for high-quality optical products, particularly in the fields of healthcare and consumer electronics. Surveys show that 75% of consumers are willing to pay a premium for products that offer superior optical clarity and durability. Additionally, the increasing awareness of the importance of eye health has led to a rise in demand for optical ceramics used in eyewear and medical devices. This shift in consumer behavior is prompting manufacturers to innovate and enhance product offerings to meet these expectations.

- Technological

- Technological advancements are playing a pivotal role in the Optical Ceramics market in 2024. The introduction of advanced manufacturing techniques, such as additive manufacturing, has reduced production times by approximately 30%, allowing for more efficient production of complex optical components. Moreover, the integration of AI in quality control processes has improved defect detection rates by 25%, ensuring higher product reliability. These technological innovations are essential for companies aiming to maintain competitive advantages in a rapidly evolving market.

- Legal

- Legal factors affecting the Optical Ceramics market in 2024 include stringent regulations regarding product safety and environmental compliance. The European Union has implemented the REACH regulation, which requires manufacturers to register chemical substances used in their products, impacting around 10,000 companies in the optical materials sector. Additionally, intellectual property laws are becoming increasingly important, with over 1,200 patents filed in the optical ceramics domain in the past year, highlighting the competitive nature of innovation in this market.

- Environmental

- Environmental considerations are increasingly influencing the Optical Ceramics market in 2024, with a focus on sustainable practices. Approximately 40% of manufacturers are now adopting eco-friendly production methods to reduce carbon emissions, in line with global sustainability goals. Furthermore, the recycling of optical ceramics is gaining traction, with an estimated 15% of materials being recycled in the production process, which not only conserves resources but also reduces waste. This shift towards sustainability is becoming a key differentiator for companies in the market.

Porter's Five Forces

- Threat of New Entrants

- Medium - The Optical Ceramics market has moderate barriers to entry due to the need for specialized technology and expertise in manufacturing. While the initial investment can be high, the growing demand for advanced optical materials may attract new players. However, established companies with strong brand recognition and customer loyalty pose a challenge for newcomers.

- Bargaining Power of Suppliers

- Low - The bargaining power of suppliers in the Optical Ceramics market is relatively low. There are numerous suppliers of raw materials and components, which reduces their influence over pricing. Additionally, companies can often switch suppliers without significant costs, further diminishing supplier power.

- Bargaining Power of Buyers

- High - Buyers in the Optical Ceramics market have high bargaining power due to the availability of alternative products and the presence of multiple suppliers. Customers can easily compare prices and quality, leading to increased pressure on manufacturers to offer competitive pricing and superior products.

- Threat of Substitutes

- Medium - The threat of substitutes in the Optical Ceramics market is moderate. While there are alternative materials available, such as plastics and metals, they may not offer the same optical properties or performance. However, advancements in technology could lead to the development of new substitutes that may challenge traditional optical ceramics.

- Competitive Rivalry

- High - Competitive rivalry in the Optical Ceramics market is high, with several established players vying for market share. Companies are constantly innovating and improving their products to differentiate themselves. The rapid pace of technological advancements and the need for high-quality materials further intensify competition among manufacturers.

SWOT Analysis

Strengths

- High durability and resistance to thermal shock, making optical ceramics suitable for various applications.

- Growing demand in the electronics and telecommunications sectors for advanced optical components.

- Innovative manufacturing techniques leading to improved product quality and performance.

Weaknesses

- High production costs associated with advanced optical ceramics.

- Limited awareness and understanding of optical ceramics among potential end-users.

- Challenges in scaling production to meet increasing demand.

Opportunities

- Expansion of applications in emerging technologies such as augmented reality and virtual reality.

- Increasing investments in research and development for new optical ceramic materials.

- Potential for partnerships with tech companies to integrate optical ceramics into new products.

Threats

- Intense competition from alternative materials and technologies.

- Economic fluctuations that could impact investment in high-tech sectors.

- Regulatory challenges related to material sourcing and environmental impact.

Summary

The Optical Ceramics market in 2024 is characterized by strong durability and growing demand in high-tech sectors, presenting significant opportunities for innovation and application expansion. However, challenges such as high production costs and competition from alternative materials may hinder growth. Strategic partnerships and investments in R&D could help leverage the strengths and opportunities while mitigating threats.

Leave a Comment