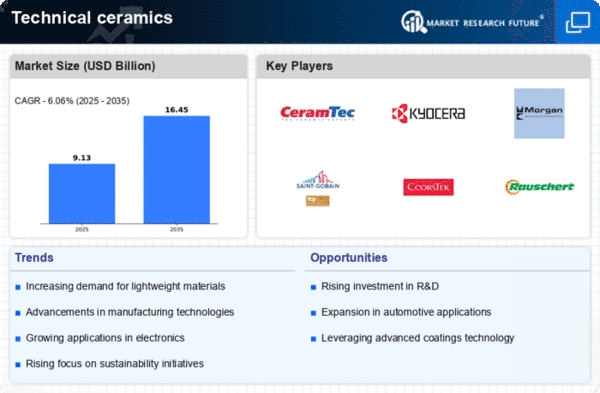

North America : Innovation and Demand Growth

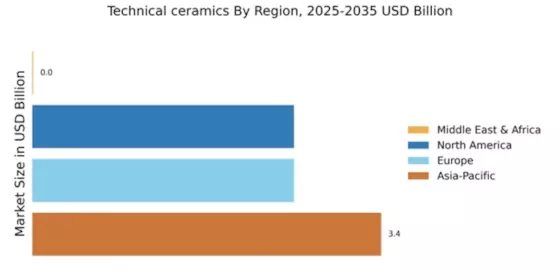

The North American technical ceramics market, valued at $2.58B, is driven by increasing demand in aerospace, automotive, and electronics sectors. Regulatory support for advanced materials and sustainability initiatives are key growth catalysts. The region's focus on innovation and R&D is expected to enhance market dynamics, with a growing emphasis on high-performance ceramics.

Leading countries like the US and Canada are home to major players such as CoorsTek Inc. and 3M Company. The competitive landscape is characterized by a mix of established firms and emerging startups, fostering innovation. The presence of key players ensures a robust supply chain, while collaborations and partnerships are likely to enhance market penetration and product offerings.

Europe : Strong Manufacturing Base

Europe's technical ceramics market, also valued at $2.58B, is characterized by a strong manufacturing base and diverse applications across industries such as healthcare, automotive, and electronics. The region benefits from stringent regulations promoting high-quality materials, which drive demand for advanced ceramics. The market is expected to grow as industries increasingly adopt these materials for their superior properties.

Germany, France, and the UK are leading countries in this sector, with key players like CeramTec GmbH and Saint-Gobain. The competitive landscape is marked by innovation and collaboration among companies, enhancing product development. The presence of research institutions further supports advancements in technical ceramics, ensuring Europe remains a key player in the global market.

Asia-Pacific : Emerging Powerhouse in Ceramics

The Asia-Pacific region holds the largest market share in the technical ceramics sector, valued at $3.44B. Rapid industrialization, urbanization, and technological advancements are driving demand across various sectors, including electronics, automotive, and energy. Government initiatives promoting advanced manufacturing and sustainable practices are further catalyzing market growth, making this region a focal point for investment.

Countries like Japan, China, and South Korea are at the forefront, with major players such as Kyocera Corporation and NGK Insulators Ltd. dominating the landscape. The competitive environment is characterized by a mix of local and international firms, fostering innovation and collaboration. The region's strong supply chain and manufacturing capabilities position it as a leader in The Technical ceramics.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa technical ceramics market is valued at $0.01B, reflecting slow growth but significant potential. Factors such as increasing industrialization and demand for advanced materials in sectors like construction and electronics are expected to drive future growth. Regulatory frameworks are gradually evolving to support the adoption of high-performance ceramics, which could enhance market dynamics.

Countries like South Africa and the UAE are beginning to invest in advanced materials, although the market remains fragmented. The presence of a few key players, along with emerging local companies, indicates a developing competitive landscape. As infrastructure projects increase, the demand for technical ceramics is likely to rise, presenting opportunities for growth in this region.