Advancements in Medical Technology

Technological advancements in medical devices and treatment methodologies are significantly influencing the Optic Nerve Atrophy Treatment Market. Innovations such as optical coherence tomography (OCT) and advanced imaging techniques enable earlier and more accurate diagnosis of optic nerve atrophy. These technologies facilitate better monitoring of disease progression and treatment efficacy, which is crucial for patient management. Furthermore, the integration of artificial intelligence in diagnostic tools is expected to enhance the precision of assessments, leading to improved patient outcomes. As these technologies become more accessible, healthcare providers are likely to adopt them, thereby driving market growth. The increasing reliance on technology in ophthalmology not only improves treatment options but also fosters a competitive environment among manufacturers to develop cutting-edge solutions.

Increasing Awareness and Education

There is a growing emphasis on awareness and education regarding optic nerve atrophy and its associated conditions, which serves as a vital driver for the Optic Nerve Atrophy Treatment Market. Campaigns aimed at educating both healthcare professionals and the public about the symptoms and risks of optic nerve atrophy are becoming more prevalent. This heightened awareness is likely to lead to earlier diagnosis and treatment, ultimately improving patient outcomes. Additionally, educational initiatives are fostering a better understanding of the importance of regular eye examinations, which can facilitate timely intervention. As awareness increases, more patients are expected to seek treatment, thereby expanding the market. The collaboration between healthcare providers and patient advocacy groups plays a crucial role in disseminating information and promoting proactive management of eye health.

Rising Prevalence of Eye Disorders

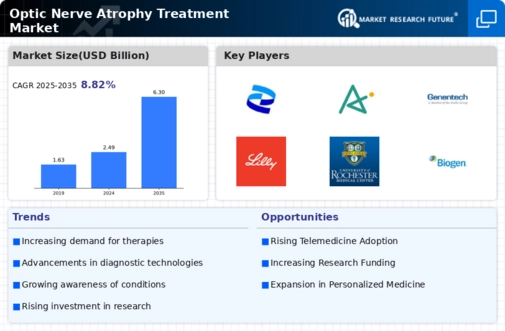

The increasing incidence of eye disorders, particularly those leading to optic nerve atrophy, is a primary driver for the Optic Nerve Atrophy Treatment Market. Conditions such as glaucoma, multiple sclerosis, and ischemic optic neuropathy contribute to the growing patient population. According to recent data, the prevalence of glaucoma alone is projected to reach 80 million cases by 2025, underscoring the urgent need for effective treatment options. This rising prevalence not only heightens awareness among healthcare providers but also stimulates demand for innovative therapies. As more individuals seek treatment, the market is likely to expand, attracting investments in research and development. Consequently, pharmaceutical companies are increasingly focusing on developing targeted therapies that address the underlying causes of optic nerve atrophy, thereby enhancing the overall treatment landscape.

Regulatory Support for Innovative Therapies

Regulatory bodies are increasingly supporting the development and approval of innovative therapies for optic nerve atrophy, which is a significant driver for the Optic Nerve Atrophy Treatment Market. Initiatives aimed at expediting the approval process for breakthrough therapies are encouraging pharmaceutical companies to invest in research and development. For instance, the designation of certain treatments as orphan drugs can provide incentives such as tax credits and extended market exclusivity. This regulatory support not only accelerates the availability of new treatments but also enhances the competitive landscape within the market. As more innovative therapies receive approval, patients will have access to a broader range of options, potentially improving treatment outcomes. The proactive stance of regulatory agencies is likely to foster a more dynamic and responsive market environment.

Growing Investment in Research and Development

The Optic Nerve Atrophy Treatment Market is witnessing a surge in investment directed towards research and development. Pharmaceutical companies and research institutions are increasingly allocating resources to explore novel therapeutic approaches, including gene therapy and neuroprotective agents. This trend is driven by the recognition of optic nerve atrophy as a significant cause of irreversible vision loss. Recent reports indicate that The Optic Nerve Atrophy Treatment Market is expected to reach USD 50 billion by 2026, reflecting the potential for growth in this sector. As more entities invest in R&D, the likelihood of discovering effective treatments increases, which could transform the treatment landscape for optic nerve atrophy. This influx of funding not only supports innovation but also encourages collaboration between academia and industry, fostering a robust ecosystem for developing new therapies.