Market Analysis

In-depth Analysis of Operational Intelligence Market Industry Landscape

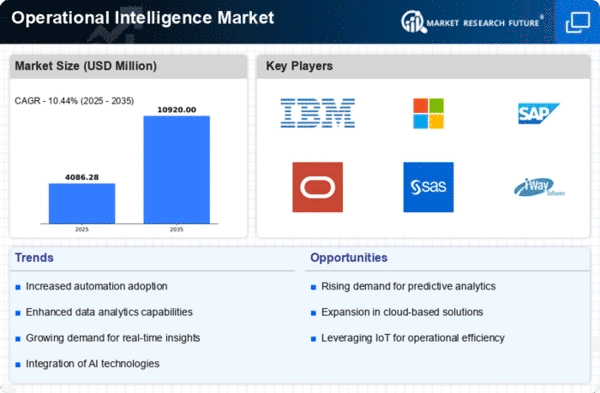

The OpInt (OI) market is undergoing dynamic shifts as companies increasingly recognize its crucial role in improving operational efficiency and decision-making processes. OI involves real-time analysis of data generated by various systems and processes within an organization, which produces actionable insights for improved overall performance. One major driver behind the evolving dynamics of operational intelligence is the skyrocketing volume and complexity of data produced across industries globally. The Internet of Things (IoT) has brought about numerous connected devices, leading to huge data volumes that are overwhelming organizations today. Enterprises turn to OI to harness the power of such data, extracting meaningful insights that drive informed autonomous direction and streamline operations. Furthermore, the growing demand for real-time monitoring and response mechanisms is fueling growth in the operational intelligence market. In today's fast-paced business environment, delays in identifying and resolving issues can have significant consequences. The increasing adoption of cloud-based operational intelligence solutions also shapes the market dynamics. Cloud platforms offer scalability, flexibility, and cost-effectiveness, thus making them attractive to companies seeking to deploy OI capabilities. This move towards cloud-based solutions facilitates easier implementation but, at the same time, guarantees seamless integration with existing IT systems. Cutting-edge innovations like AI (ML) and artificial intelligence have penetrated operational intelligence systems. These two techniques enhance the intelligent capabilities of OI systems, enabling them to detect previously unnoticed trends and patterns that are hidden by conventional methodology. The competitive environment in the operational intelligence market is saturated with numerous suppliers providing various solutions. This variety caters to the unique needs and preferences of different industries, which range from manufacturing and healthcare to finance and integrated factors. In addition, global regulatory environments as well as data privacy concerns also play a crucial role in shaping market dynamics. Governments globally have enacted strict data protection regulations, leading organizations to adopt only OI solutions that comply with these regulations.

Leave a Comment