Rising Demand for Premium Tea

The Oolong Tea Market experiences a notable increase in demand for premium and specialty teas. Consumers are increasingly seeking high-quality products that offer unique flavors and health benefits. This trend is reflected in the growing number of tea connoisseurs who appreciate the intricate processing methods of Oolong tea. According to recent data, the premium tea segment is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This shift towards premiumization is likely to drive innovation in the Oolong Tea Market, as producers strive to meet the evolving preferences of discerning consumers.

E-commerce Growth and Online Sales

The Oolong Tea Market is witnessing a transformative shift due to the rapid growth of e-commerce platforms. Online sales of Oolong tea have surged, driven by the convenience of shopping from home and the ability to access a wider variety of products. Recent statistics reveal that online tea sales have increased by over 30% in the past year, indicating a strong consumer preference for digital purchasing. This trend presents a significant opportunity for Oolong tea brands to expand their reach and engage with a broader audience, thereby enhancing their market presence within the Oolong Tea Market.

Health Benefits and Functional Beverages

The Oolong Tea Market is significantly influenced by the rising awareness of health benefits associated with tea consumption. Oolong tea is known for its potential to aid in weight management, improve metabolism, and enhance mental alertness. As consumers increasingly prioritize health and wellness, the demand for functional beverages, including Oolong tea, is expected to rise. Market data indicates that the health-focused beverage segment is anticipated to grow by 8% annually, suggesting a robust opportunity for Oolong tea producers to position their products as health-enhancing options within the Oolong Tea Market.

Sustainability and Eco-Friendly Practices

Sustainability is becoming a crucial driver in the Oolong Tea Market as consumers increasingly favor products that align with their environmental values. The demand for sustainably sourced and eco-friendly tea options is on the rise, prompting producers to adopt responsible farming practices. Recent surveys indicate that over 70% of consumers are willing to pay a premium for sustainably sourced products. This trend not only enhances brand loyalty but also encourages innovation in packaging and production methods within the Oolong Tea Market, as companies strive to meet the expectations of environmentally conscious consumers.

Cultural Influence and Tea Consumption Trends

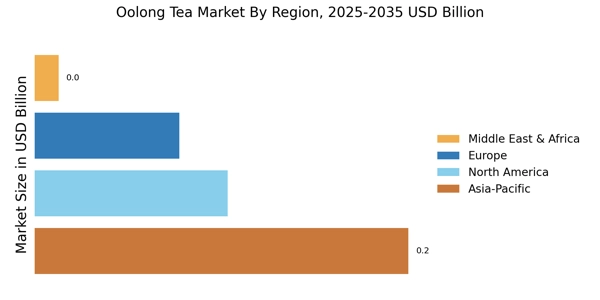

Cultural factors play a pivotal role in shaping the Oolong Tea Market. The appreciation for tea, particularly in Asian cultures, continues to influence consumption patterns globally. Oolong tea, with its rich heritage and traditional brewing methods, appeals to consumers seeking authentic experiences. As cultural exchanges increase, the popularity of Oolong tea is likely to expand beyond its traditional markets. Market analysis suggests that regions with growing interest in tea culture, such as North America and Europe, may see a rise in Oolong tea consumption, further driving growth in the Oolong Tea Market.