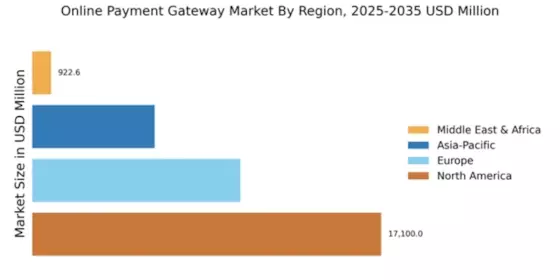

North America : Market Leader in Innovation

North America continues to lead the Online Payment Gateway Market, holding a significant market share of 17100.0. The region's growth is driven by increasing e-commerce activities, technological advancements, and a robust regulatory framework that supports digital transactions. The demand for secure and efficient payment solutions is further fueled by consumer preferences for online shopping and mobile payments, making it a hotbed for innovation in payment technologies.

The competitive landscape is characterized by major players such as PayPal, Stripe, and Square, which dominate the market with their advanced payment solutions. The U.S. remains the largest contributor, with a strong presence of fintech companies and a favorable business environment. This competitive edge is enhanced by continuous investments in technology and partnerships that expand service offerings, ensuring that North America retains its leadership position in the global market.

Europe : Emerging Market with Potential

Europe's Online Payment Gateway Market is poised for growth, with a market size of 10200.0. The region benefits from a high level of internet penetration and a growing preference for cashless transactions. Regulatory initiatives, such as the PSD2 directive, are catalyzing the shift towards more secure and efficient payment methods, driving demand for innovative payment solutions across various sectors.

Leading countries like Germany, the UK, and France are at the forefront of this transformation, with a competitive landscape featuring key players such as Adyen and Worldpay. The presence of established financial institutions and a strong startup ecosystem further enhances the market's dynamics. As digital payment adoption accelerates, Europe is set to become a significant player in the global online payment landscape.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region, with a market size of 6000.0, is experiencing a rapid surge in the Online Payment Gateway Market, driven by the exponential growth of e-commerce and mobile payment adoption. Countries like China and India are leading this trend, supported by increasing smartphone penetration and a young, tech-savvy population. Regulatory frameworks are also evolving to facilitate digital transactions, enhancing consumer trust and security in online payments.

China, with Alipay and other local players, dominates the market, while India is witnessing a rise in fintech startups that offer innovative payment solutions. The competitive landscape is vibrant, with both The Online Payment Gateway share. As the region continues to embrace digital transformation, the online payment gateway market is expected to expand significantly, catering to diverse consumer needs.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) region, with a market size of 922.63, is gradually emerging as a significant player in the Online Payment Gateway Market. The growth is driven by increasing internet penetration, mobile device usage, and a shift towards cashless transactions. Governments are implementing policies to promote digital payments, which are crucial for economic development and financial inclusion in the region.

Countries like South Africa and the UAE are leading the charge, with a growing number of fintech companies entering the market. The competitive landscape is evolving, with both local and international players striving to capture market share. As the region continues to develop its digital infrastructure, the online payment gateway market is expected to witness substantial growth, catering to the needs of a diverse consumer base.