Rise of Targeted Therapies

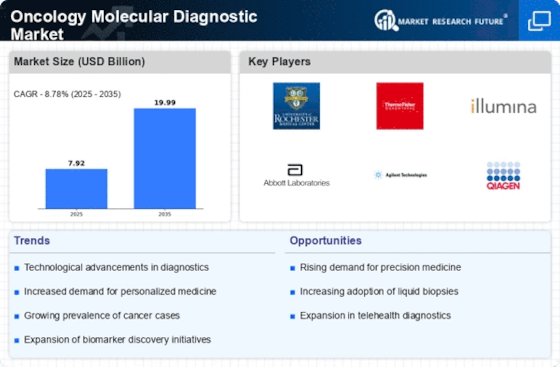

The Oncology Molecular Diagnostic Market is experiencing a notable shift towards targeted therapies, which are designed to treat specific genetic mutations associated with various cancers. This trend is driven by the increasing understanding of cancer genomics and the role of biomarkers in treatment selection. As of 2025, the market for targeted therapies is projected to reach approximately 100 billion USD, reflecting a compound annual growth rate of around 10%. This growth is indicative of the rising demand for precision medicine, which necessitates advanced molecular diagnostics to identify suitable candidates for these therapies. Consequently, the Oncology Molecular Diagnostic Market is likely to expand as healthcare providers seek to integrate these diagnostics into routine clinical practice, thereby enhancing treatment efficacy and patient outcomes.

Growing Incidence of Cancer

The Oncology Molecular Diagnostic Market is significantly influenced by the increasing incidence of cancer worldwide. According to recent statistics, cancer cases are expected to rise by 30% by 2030, necessitating improved diagnostic tools to facilitate early detection and treatment. This surge in cancer prevalence is prompting healthcare systems to invest in advanced molecular diagnostics, which can provide critical insights into tumor biology and patient-specific treatment options. As a result, the demand for innovative diagnostic solutions is likely to escalate, driving growth in the Oncology Molecular Diagnostic Market. Furthermore, the rising burden of cancer is compelling governments and organizations to prioritize funding for research and development in this field, thereby fostering advancements in molecular diagnostic technologies.

Rising Demand for Liquid Biopsies

The Oncology Molecular Diagnostic Market is witnessing a growing demand for liquid biopsies, which offer a non-invasive alternative to traditional tissue biopsies for cancer diagnosis and monitoring. Liquid biopsies enable the detection of circulating tumor DNA and other biomarkers in blood samples, providing valuable insights into tumor dynamics and treatment response. As of 2025, the liquid biopsy market is projected to grow at a compound annual growth rate of over 20%, reflecting the increasing preference for minimally invasive diagnostic methods. This trend is likely to drive innovation within the Oncology Molecular Diagnostic Market, as companies invest in developing advanced liquid biopsy technologies that can enhance early detection and personalized treatment strategies.

Integration of Artificial Intelligence

The Oncology Molecular Diagnostic Market is increasingly incorporating artificial intelligence (AI) technologies to enhance diagnostic accuracy and efficiency. AI algorithms are being utilized to analyze complex genomic data, enabling faster and more precise identification of cancer-related mutations. This integration is expected to revolutionize the way molecular diagnostics are conducted, as AI can significantly reduce the time required for data interpretation. By 2025, it is anticipated that AI-driven solutions will account for a substantial portion of the market, potentially improving diagnostic outcomes and streamlining workflows in clinical laboratories. The Oncology Molecular Diagnostic Market is likely to benefit from this technological advancement, as healthcare providers seek to leverage AI to optimize patient care and treatment decisions.

Regulatory Support for Molecular Diagnostics

The Oncology Molecular Diagnostic Market benefits from increasing regulatory support aimed at expediting the approval of innovative diagnostic tests. Regulatory bodies are recognizing the importance of molecular diagnostics in improving patient care and are streamlining the approval processes for these technologies. For instance, initiatives such as the Breakthrough Devices Program in various regions are designed to facilitate faster access to critical diagnostic tools. This supportive regulatory environment is likely to encourage investment in research and development, leading to the introduction of novel molecular diagnostic solutions. As a result, the Oncology Molecular Diagnostic Market is expected to witness accelerated growth, as more diagnostic tests gain approval and become available to healthcare providers, ultimately enhancing patient management strategies.