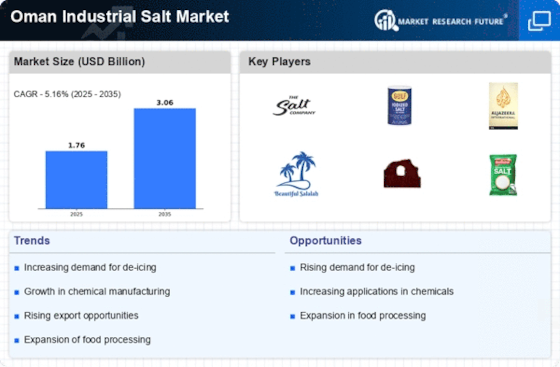

Emergence of Export Opportunities

The Oman Industrial Salt Market is witnessing the emergence of export opportunities, driven by the increasing global demand for industrial salt. Oman, with its strategic geographical location and abundant natural resources, is well-positioned to cater to international markets. The country has been actively exploring export avenues, particularly to neighboring regions where industrial salt is in high demand for various applications. The export potential is further enhanced by the establishment of trade agreements and partnerships, which may facilitate smoother access to foreign markets. This trend could significantly boost the Oman Industrial Salt Market, as local producers seek to expand their reach beyond domestic consumption.

Expansion of Food Processing Sector

The Oman Industrial Salt Market is also benefiting from the expansion of the food processing sector. Industrial salt is utilized in various food preservation and processing methods, including curing and flavor enhancement. As consumer preferences shift towards processed and packaged foods, the demand for industrial salt in this sector is likely to increase. The food processing industry in Oman has been growing steadily, with an estimated market size of around 500 million Omani Rials. This growth presents a substantial opportunity for the Oman Industrial Salt Market, as food manufacturers seek to source high-quality salt for their production processes.

Rising Demand from Chemical Industry

The Oman Industrial Salt Market is experiencing a notable increase in demand from the chemical sector. Industrial salt serves as a fundamental raw material in the production of various chemicals, including chlorine and caustic soda. As the chemical industry expands, driven by the need for diverse applications, the demand for industrial salt is projected to rise. In Oman, the chemical sector has shown robust growth, with production levels reaching approximately 1.5 million tons annually. This growth is likely to bolster the Oman Industrial Salt Market, as manufacturers seek reliable sources of high-quality salt to meet their production needs.

Growth in Water Treatment Applications

The Oman Industrial Salt Market is significantly influenced by the increasing utilization of industrial salt in water treatment processes. Salt is essential in the production of chlorine, which is widely used for disinfection and purification of water. With the rising awareness of water quality and safety, municipalities and industries are investing in advanced water treatment facilities. This trend is expected to drive the demand for industrial salt, as it is a critical component in ensuring clean and safe water. The market for water treatment chemicals in Oman is projected to grow at a compound annual growth rate of 5% over the next five years, further enhancing the prospects for the Oman Industrial Salt Market.

Infrastructure Development Initiatives

The Oman Industrial Salt Market is poised to benefit from ongoing infrastructure development initiatives across the country. The government has been investing in various infrastructure projects, including roads, ports, and industrial zones, which are expected to stimulate economic growth. These developments may lead to increased industrial activity, thereby driving the demand for industrial salt in construction and other related sectors. The construction industry in Oman is projected to grow at a rate of 6% annually, creating a favorable environment for the Oman Industrial Salt Market to thrive as it supplies essential materials for construction processes.