Growth in Agricultural Applications

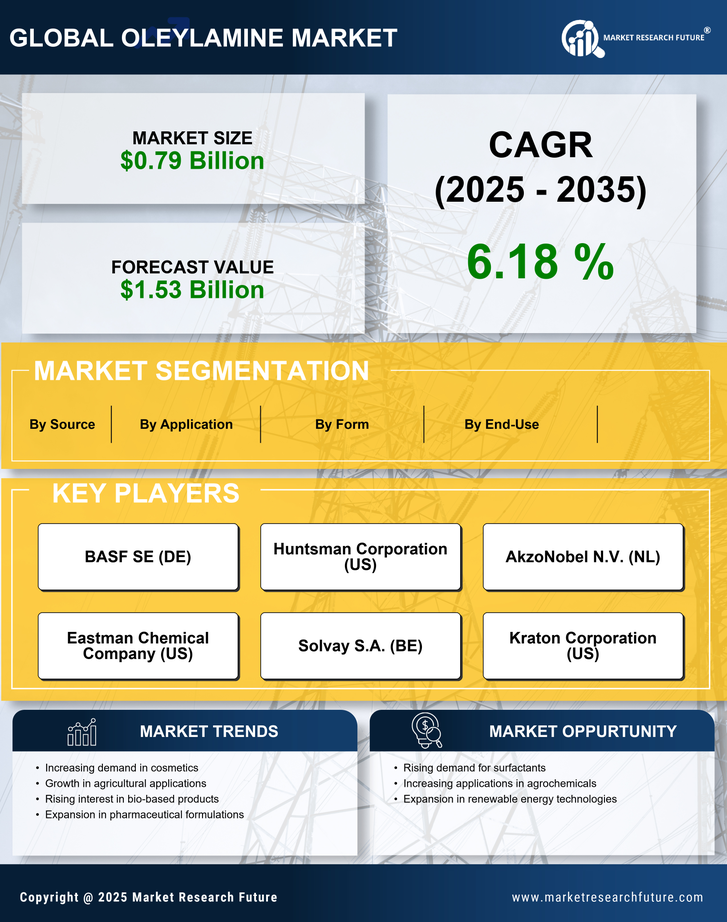

The Oleylamine Market is witnessing growth driven by its expanding applications in agriculture. Oleylamine Market is utilized as a surfactant in agrochemical formulations, enhancing the efficacy of pesticides and herbicides. The agricultural sector is increasingly adopting oleylamine-based products to improve crop yield and pest management. According to recent data, the agrochemical market is expected to reach USD 300 billion by 2026, indicating a substantial opportunity for oleylamine. This growth is likely to be fueled by the rising need for sustainable agricultural practices and the demand for higher productivity. As farmers seek effective solutions to combat pests and diseases, the incorporation of oleylamine in agricultural products may become more prevalent, thereby propelling the Oleylamine Market forward.

Rising Demand in Personal Care Products

The Oleylamine Market is experiencing a notable increase in demand due to its application in personal care products. Oleylamine Market serves as an emulsifier and surfactant, enhancing the texture and stability of creams, lotions, and hair care products. The personal care sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years, which could significantly boost the demand for oleylamine. As consumers increasingly seek high-quality and effective personal care solutions, manufacturers are likely to incorporate oleylamine into their formulations, thereby driving growth in the Oleylamine Market. This trend suggests a shift towards more sophisticated and multifunctional ingredients in personal care, which may further solidify oleylamine's position in the market.

Increasing Use in Industrial Applications

The Oleylamine Market is benefiting from the increasing use of oleylamine in various industrial applications. Its properties as a corrosion inhibitor and surfactant make it valuable in sectors such as textiles, plastics, and coatings. The textile industry, for instance, utilizes oleylamine in the production of fibers and finishes, enhancing the quality and durability of fabrics. The coatings sector also employs oleylamine to improve adhesion and performance. As industries continue to seek high-performance materials, the demand for oleylamine is likely to rise. Market data suggests that the industrial chemicals market is projected to grow at a rate of 4% annually, which may further bolster the Oleylamine Market as manufacturers look for effective solutions to meet evolving industry standards.

Regulatory Support for Sustainable Chemicals

The Oleylamine Market is poised for growth due to increasing regulatory support for sustainable chemicals. Governments and regulatory bodies are promoting the use of environmentally friendly substances in various applications, including personal care, agriculture, and industrial processes. This regulatory landscape encourages manufacturers to adopt oleylamine, which can be produced sustainably and offers multifunctional benefits. As regulations become more stringent regarding chemical safety and environmental impact, the demand for sustainable alternatives like oleylamine is likely to increase. This trend may lead to a shift in consumer preferences towards products that are not only effective but also environmentally responsible, thereby enhancing the growth prospects of the Oleylamine Market.

Technological Innovations in Chemical Manufacturing

Technological advancements in chemical manufacturing are significantly influencing the Oleylamine Market. Innovations such as green chemistry and more efficient production processes are enabling manufacturers to produce oleylamine with reduced environmental impact. The introduction of novel synthesis methods may lead to cost-effective production, which could enhance the competitiveness of oleylamine in various applications. Furthermore, the development of new formulations that utilize oleylamine is likely to emerge, expanding its utility across different sectors. As the industry moves towards more sustainable practices, the ability to produce oleylamine in an eco-friendly manner may attract new customers and applications, thereby fostering growth in the Oleylamine Market.