North America : Market Leader in Services

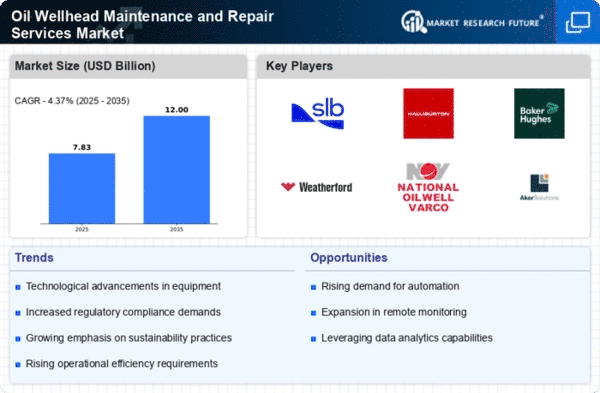

North America continues to lead the Oil Wellhead Maintenance and Repair Services market, holding a significant share of 3.75 billion. The region's growth is driven by increasing oil production, technological advancements, and stringent safety regulations. The demand for efficient maintenance services is further fueled by the need to optimize operational costs and enhance production efficiency. Regulatory frameworks supporting sustainable practices also play a crucial role in shaping market dynamics. The United States is the primary contributor to this market, with major players like Schlumberger, Halliburton, and Baker Hughes dominating the landscape. The competitive environment is characterized by continuous innovation and strategic partnerships among key players. The presence of advanced technologies and a skilled workforce further strengthens the region's position, ensuring a robust market for oil wellhead services.

Europe : Emerging Market Potential

Europe's Oil Wellhead Maintenance and Repair Services market is valued at 2.0 billion, reflecting a growing demand driven by the region's commitment to energy security and sustainability. The increasing focus on renewable energy sources and the transition to cleaner technologies are influencing the market landscape. Regulatory initiatives aimed at reducing carbon emissions are also propelling investments in maintenance services, ensuring compliance with environmental standards. Leading countries such as Norway, the UK, and Germany are at the forefront of this market, with key players like Aker Solutions and TechnipFMC actively participating. The competitive landscape is evolving, with companies investing in innovative solutions to enhance service efficiency. The presence of established firms and a growing number of startups indicates a dynamic market environment, fostering growth and collaboration in the oil wellhead services sector.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region, with a market size of 1.5 billion, is witnessing rapid growth in Oil Wellhead Maintenance and Repair Services. This growth is primarily driven by increasing energy demands, particularly in countries like China and India, where industrialization and urbanization are accelerating. Additionally, government initiatives to enhance oil production and improve infrastructure are acting as catalysts for market expansion. The region's focus on energy independence is also contributing to the rising demand for maintenance services. China and India are the leading countries in this market, with a mix of local and international players competing for market share. Companies like Weatherford International and National Oilwell Varco are establishing a strong presence, leveraging technological advancements to improve service delivery. The competitive landscape is characterized by partnerships and collaborations aimed at enhancing operational efficiency and meeting the growing demand for oil wellhead services.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region, with a market size of 0.25 billion, presents significant opportunities in the Oil Wellhead Maintenance and Repair Services sector. The region's vast oil reserves and ongoing investments in oil infrastructure are key drivers of market growth. Additionally, the increasing focus on operational efficiency and safety standards is pushing companies to seek advanced maintenance solutions. Regulatory frameworks are evolving to support sustainable practices, further enhancing market prospects. Countries like Saudi Arabia and the UAE are leading the market, with major players such as Oceaneering International and Cameron International actively involved. The competitive landscape is marked by a mix of established firms and emerging players, all vying for a share of the growing market. The region's strategic importance in global oil supply chains ensures a robust demand for wellhead services, fostering a dynamic market environment.