North America : Market Leader in MRO Services

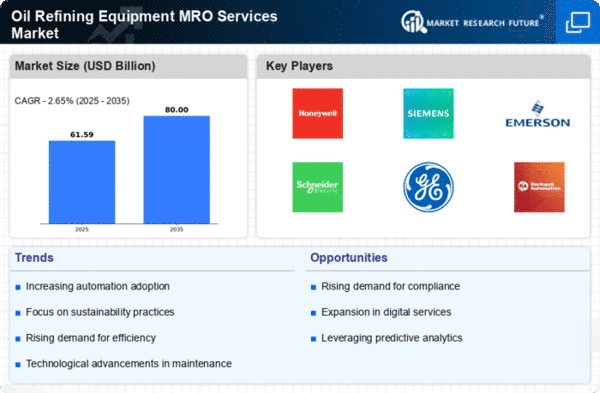

North America is poised to maintain its leadership in the Oil Refining Equipment MRO Services market, holding a significant market share of 30.0 in 2025. The region's growth is driven by increasing demand for efficient refining processes, stringent environmental regulations, and technological advancements. The focus on sustainability and operational efficiency is further propelling investments in MRO services, ensuring compliance with regulatory standards. The competitive landscape in North America is robust, featuring key players such as Honeywell, Emerson Electric, and General Electric. These companies are leveraging innovative technologies to enhance service offerings and improve operational efficiency. The U.S. remains the largest market, supported by a well-established infrastructure and a strong emphasis on refining capacity. The presence of major industry players fosters a dynamic environment for growth and innovation.

Europe : Emerging Market with Regulations

Europe's Oil Refining Equipment MRO Services market is characterized by a market size of 15.0 in 2025, driven by stringent regulations aimed at reducing emissions and enhancing safety standards. The European Union's commitment to sustainability and energy efficiency is a key catalyst for growth, pushing refiners to invest in MRO services that comply with evolving regulations. This regulatory landscape is expected to foster innovation and improve service quality across the region. Leading countries in Europe, such as Germany and France, are home to major players like Siemens and Schneider Electric. The competitive landscape is marked by a focus on technological advancements and partnerships to enhance service delivery. The presence of established firms and a growing emphasis on digital transformation in MRO services position Europe as a significant player in the global market.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region, with a market size of 10.0 in 2025, is witnessing rapid growth in the Oil Refining Equipment MRO Services sector. This growth is fueled by increasing energy demands, urbanization, and the expansion of refining capacities in countries like China and India. The region's focus on modernizing infrastructure and enhancing operational efficiency is driving investments in MRO services, making it a key area for future growth. China and India are leading the charge in the Asia-Pacific market, with significant investments from key players such as Mitsubishi Heavy Industries and Rockwell Automation. The competitive landscape is evolving, with local firms emerging alongside established global players. The region's potential for expansion is immense, as governments prioritize energy security and sustainability in their policies.

Middle East and Africa : Resource-Rich Market Potential

The Middle East and Africa region, with a market size of 5.0 in 2025, presents unique opportunities in the Oil Refining Equipment MRO Services market. The region's rich natural resources and increasing investments in refining infrastructure are driving demand for MRO services. Additionally, government initiatives aimed at diversifying economies and enhancing energy efficiency are expected to catalyze growth in this sector. Countries like Saudi Arabia and the UAE are at the forefront of this growth, with significant investments in refining capabilities. The competitive landscape includes both local and international players, creating a dynamic environment for MRO services. As the region continues to develop its refining sector, the demand for high-quality MRO services is anticipated to rise, offering substantial growth potential.