Increasing Focus on Sustainability

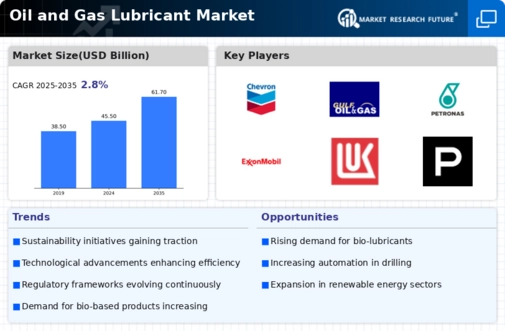

The Oil and Gas Lubricant Market is witnessing a growing focus on sustainability, driven by both consumer demand and corporate responsibility. Companies are increasingly prioritizing environmentally friendly practices, leading to a rise in the development of bio-based and renewable lubricants. This shift is not merely a trend but appears to be a fundamental change in how the industry operates. Recent data suggests that the market for bio-lubricants is expected to grow at a rate of 5% annually, reflecting the increasing acceptance of sustainable products. As organizations strive to reduce their carbon footprint, the Oil and Gas Lubricant Market is likely to adapt by incorporating more sustainable practices into their operations. This emphasis on sustainability not only meets regulatory requirements but also enhances brand reputation and customer loyalty.

Expansion of Exploration Activities

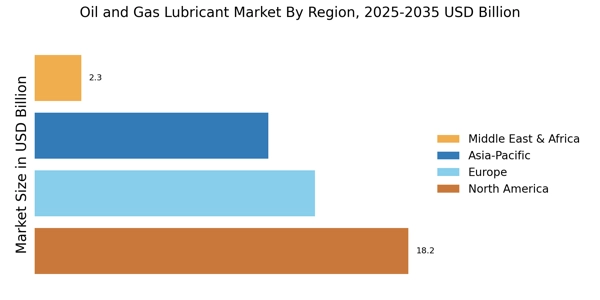

The Oil and Gas Lubricant Market is significantly influenced by the expansion of exploration activities in untapped regions. As energy demands continue to rise, companies are venturing into new territories, including offshore and unconventional resources. This expansion necessitates the use of specialized lubricants that can withstand extreme conditions and enhance equipment reliability. Recent statistics indicate that exploration spending is expected to increase by 6% in the coming year, further driving the demand for high-quality lubricants. The need for effective lubrication solutions in challenging environments underscores the importance of innovation within the Oil and Gas Lubricant Market. As exploration activities intensify, the market is poised for growth, with a focus on developing lubricants that cater to the unique challenges presented by these new frontiers.

Regulatory Compliance and Standards

The Oil and Gas Lubricant Market is increasingly shaped by stringent regulatory compliance and standards aimed at ensuring environmental protection and operational safety. Governments and regulatory bodies are implementing more rigorous guidelines regarding lubricant formulations, usage, and disposal. This trend compels manufacturers to innovate and adapt their products to meet these evolving regulations. For instance, the introduction of eco-friendly lubricants that comply with environmental standards is becoming a focal point for many companies. The market is projected to see a shift towards biodegradable and non-toxic lubricants, which could account for a significant portion of the market share by 2026. As compliance becomes a critical factor, the Oil and Gas Lubricant Market is likely to experience a transformation, with an emphasis on sustainable practices and products.

Rising Demand for Energy Efficiency

The Oil and Gas Lubricant Market experiences a notable increase in demand for energy-efficient solutions. As industries strive to reduce operational costs and enhance productivity, the need for high-performance lubricants becomes paramount. According to recent data, the market for energy-efficient lubricants is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This trend is driven by the growing awareness of environmental sustainability and the need for reduced energy consumption in oil and gas operations. Companies are increasingly investing in advanced lubricant formulations that offer superior performance while minimizing energy loss. Consequently, the Oil and Gas Lubricant Market is likely to witness a shift towards innovative products that align with these energy efficiency goals.

Technological Innovations in Lubricant Formulations

Technological innovations play a crucial role in shaping the Oil and Gas Lubricant Market. Advances in lubricant formulations, such as the development of synthetic and semi-synthetic lubricants, are enhancing performance and longevity. These innovations are driven by the need for lubricants that can operate effectively under extreme temperatures and pressures, which are common in oil and gas applications. Recent advancements indicate that synthetic lubricants can improve equipment efficiency by up to 15%, thereby reducing maintenance costs and downtime. As technology continues to evolve, the Oil and Gas Lubricant Market is likely to see an influx of new products that leverage cutting-edge research and development. This focus on innovation not only meets the demands of modern operations but also aligns with the industry's push towards sustainability and efficiency.