Geopolitical Factors

Geopolitical factors are increasingly impacting the Oil Gas Infrastructure Market. Political stability, trade relations, and international conflicts can significantly influence oil and gas supply chains and infrastructure investments. For instance, tensions in oil-rich regions can lead to supply disruptions, prompting countries to diversify their energy sources and invest in domestic infrastructure. Additionally, trade agreements and tariffs can affect the cost of materials and technologies necessary for infrastructure development. As nations strive for energy security, the Oil Gas Infrastructure Market may experience shifts in investment patterns, with a focus on enhancing resilience against geopolitical risks. This dynamic environment necessitates strategic planning and adaptability among industry stakeholders.

Rising Energy Demand

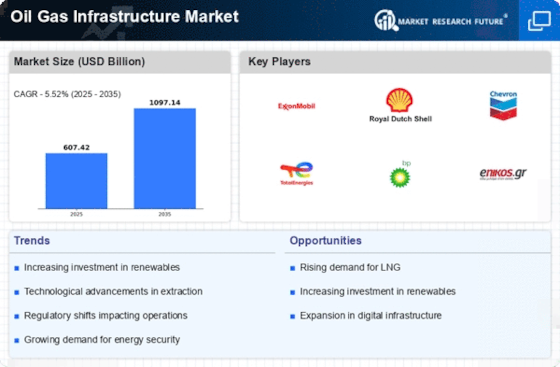

The increasing The Oil Gas Infrastructure Industry. As populations grow and economies expand, the need for reliable energy sources intensifies. According to recent estimates, energy consumption is projected to rise by approximately 30% by 2040. This surge necessitates the expansion and enhancement of oil and gas infrastructure to ensure efficient production, transportation, and distribution. The Oil Gas Infrastructure Market must adapt to these demands by investing in new technologies and upgrading existing facilities to meet the anticipated energy needs. Furthermore, the shift towards urbanization in developing regions is likely to exacerbate this demand, compelling stakeholders to prioritize infrastructure development to support economic growth.

Technological Advancements

Technological advancements play a pivotal role in shaping the Oil Gas Infrastructure Market. Innovations in drilling techniques, such as hydraulic fracturing and horizontal drilling, have revolutionized the extraction process, leading to increased production rates and reduced costs. Moreover, advancements in pipeline technology, including smart sensors and monitoring systems, enhance safety and efficiency in transportation. The integration of digital technologies, such as artificial intelligence and big data analytics, is also transforming operational processes, enabling better decision-making and predictive maintenance. As these technologies continue to evolve, they are likely to drive further investment in the Oil Gas Infrastructure Market, fostering a more resilient and efficient energy sector.

Regulatory Frameworks and Policies

Regulatory frameworks and policies significantly influence the Oil Gas Infrastructure Market. Governments worldwide are implementing stricter regulations aimed at environmental protection and safety standards. These regulations often necessitate upgrades to existing infrastructure and the development of new facilities that comply with modern standards. For instance, the introduction of carbon pricing mechanisms and emissions reduction targets is prompting companies to invest in cleaner technologies and infrastructure. This regulatory landscape creates both challenges and opportunities for the Oil Gas Infrastructure Market, as stakeholders must navigate compliance while seeking innovative solutions to meet regulatory demands. The evolving policy environment is likely to shape investment strategies and operational practices in the coming years.

Investment in Infrastructure Development

Investment in infrastructure development remains a crucial driver for the Oil Gas Infrastructure Market. Governments and private entities are increasingly allocating funds to enhance oil and gas facilities, pipelines, and refineries. In recent years, investments in oil and gas infrastructure have reached unprecedented levels, with estimates suggesting that over 1 trillion dollars will be spent on infrastructure projects by 2030. This influx of capital is essential for modernizing aging infrastructure and expanding capacity to meet future energy demands. Additionally, the Oil Gas Infrastructure Market is witnessing a trend towards public-private partnerships, which can facilitate the financing and execution of large-scale projects, thereby accelerating infrastructure development and improving overall efficiency.