Increasing Energy Demand

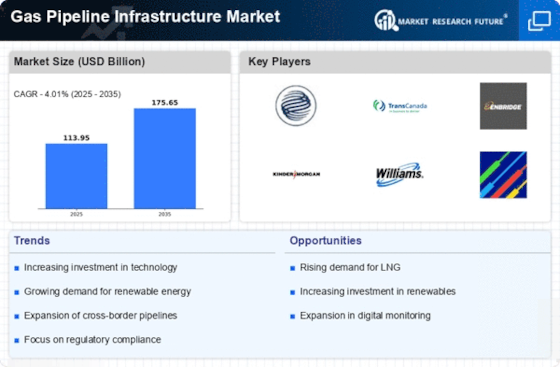

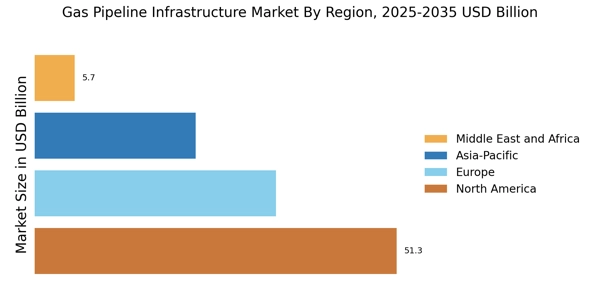

The rising The Gas Pipeline Infrastructure Industry. As economies expand and populations grow, the need for reliable energy sources intensifies. According to recent estimates, energy consumption is projected to increase by approximately 30% by 2040. This surge necessitates the development and expansion of gas pipeline networks to ensure efficient transportation of natural gas. Furthermore, the transition towards cleaner energy sources, such as natural gas, is likely to bolster investments in pipeline infrastructure. The Gas Pipeline Infrastructure Market must adapt to these changing dynamics to meet the escalating energy requirements of various sectors, including residential, commercial, and industrial applications.

Technological Innovations

Technological innovations are transforming the Gas Pipeline Infrastructure Market, enhancing efficiency and safety. Advanced monitoring systems, such as smart sensors and automated control systems, are being integrated into pipeline operations. These technologies enable real-time data collection and analysis, allowing for proactive maintenance and reducing the risk of leaks or failures. Moreover, the adoption of digital twin technology is gaining traction, providing a virtual representation of physical assets for better decision-making. As these innovations continue to evolve, they are expected to drive operational efficiencies and reduce costs, making the Gas Pipeline Infrastructure Market more competitive and sustainable in the long run.

Geopolitical Factors and Energy Security

Geopolitical factors significantly impact the Gas Pipeline Infrastructure Market, as energy security remains a paramount concern for many nations. Political instability in key gas-producing regions can disrupt supply chains and create uncertainty in energy markets. Consequently, countries are diversifying their energy sources and investing in pipeline infrastructure to enhance energy independence. For example, the construction of new pipelines connecting different regions is often seen as a strategic move to mitigate risks associated with geopolitical tensions. This trend underscores the importance of robust gas pipeline networks in ensuring stable energy supplies, thereby reinforcing the relevance of the Gas Pipeline Infrastructure Market in the current geopolitical landscape.

Investment in Infrastructure Development

Investment in infrastructure development plays a crucial role in the Gas Pipeline Infrastructure Market. Governments and private entities are increasingly allocating funds to enhance existing pipeline systems and construct new ones. For instance, the International Energy Agency has indicated that investments in gas infrastructure could reach trillions of dollars over the next decade. This financial commitment is driven by the need to improve energy security, reduce transportation costs, and facilitate the integration of renewable energy sources. Enhanced infrastructure not only supports the efficient distribution of natural gas but also contributes to job creation and economic growth, thereby reinforcing the importance of the Gas Pipeline Infrastructure Market.

Environmental Regulations and Sustainability Initiatives

Environmental regulations and sustainability initiatives are increasingly influencing the Gas Pipeline Infrastructure Market. Governments worldwide are implementing stricter regulations to minimize the environmental impact of energy production and transportation. This trend is prompting companies to invest in cleaner technologies and practices, such as carbon capture and storage, to comply with regulatory requirements. Additionally, the push for sustainability is driving the development of pipelines that minimize ecological disruption and promote the use of renewable energy sources. As a result, the Gas Pipeline Infrastructure Market is likely to see a shift towards more environmentally friendly practices, which could enhance its reputation and marketability.