Rising Demand for Energy Efficiency

In the context of the Oil and Gas Electric Packer Market, the increasing demand for energy efficiency is a pivotal driver. As energy costs continue to rise, operators are seeking solutions that minimize energy consumption while maximizing output. Electric packers, known for their lower energy requirements compared to traditional hydraulic systems, are becoming increasingly popular. This shift is supported by regulatory frameworks that encourage energy-efficient practices. Market data indicates that the energy-efficient segment of the oil and gas industry is expected to grow by approximately 6% over the next five years, highlighting the potential for electric packers to play a crucial role in meeting these demands.

Shift Towards Sustainable Practices

The Oil and Gas Electric Packer Market is witnessing a notable shift towards sustainable practices, driven by both consumer demand and corporate responsibility. Companies are increasingly adopting environmentally friendly technologies to reduce their carbon footprint. Electric packers, which typically have a lower environmental impact compared to traditional options, are becoming a preferred choice. This transition is supported by initiatives aimed at promoting sustainability within the oil and gas sector. Market projections indicate that the sustainable technology segment is expected to grow by around 8% annually, reflecting a broader commitment to sustainability in the Oil and Gas Electric Packer Market.

Regulatory Compliance and Safety Standards

The Oil and Gas Electric Packer Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are imposing more rigorous safety protocols to mitigate risks associated with oil and gas extraction. Electric packers, which offer enhanced safety features and reduced environmental impact, are increasingly favored by operators aiming to comply with these regulations. The market is witnessing a shift towards products that not only meet but exceed safety standards, which is likely to drive growth. Recent statistics suggest that compliance-related investments in the oil and gas sector could reach billions, further emphasizing the importance of safety in the Oil and Gas Electric Packer Market.

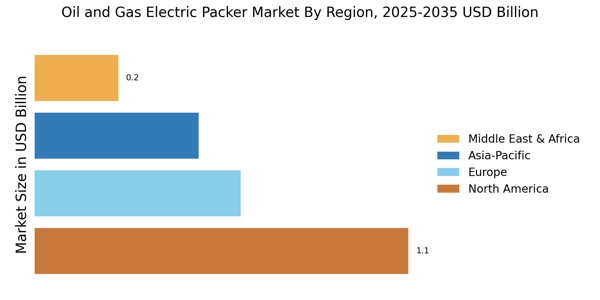

Growing Investment in Oil and Gas Exploration

Investment in oil and gas exploration is a critical driver for the Oil and Gas Electric Packer Market. As energy demands rise, companies are allocating substantial resources towards exploration activities, particularly in untapped regions. This trend is expected to bolster the demand for electric packers, which are essential for efficient well completion and production. Market analysis indicates that exploration budgets are projected to increase by approximately 7% in the coming years, suggesting a robust growth trajectory for the electric packer segment. This influx of investment is likely to enhance the overall market landscape, providing opportunities for innovation and expansion within the Oil and Gas Electric Packer Market.

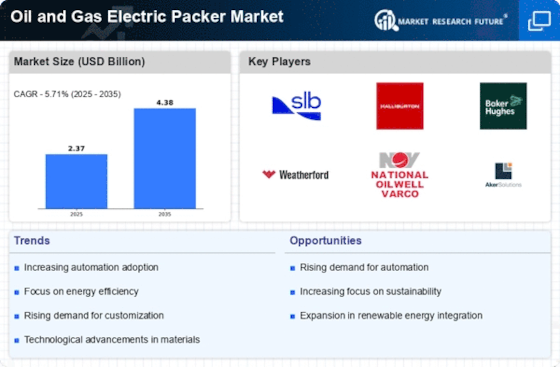

Technological Innovations in Oil and Gas Electric Packer Market

The Oil and Gas Electric Packer Market is experiencing a surge in technological innovations that enhance operational efficiency and reliability. Advanced materials and designs are being developed to withstand extreme conditions, thereby improving the performance of electric packers. For instance, the integration of smart sensors and IoT technology allows for real-time monitoring and data collection, which can lead to predictive maintenance and reduced downtime. According to recent data, the adoption of these technologies is projected to increase the market size significantly, with estimates suggesting a growth rate of over 5% annually. This trend indicates that companies investing in cutting-edge technology are likely to gain a competitive edge in the Oil and Gas Electric Packer Market.