Market Share

Introduction: Navigating the Competitive Landscape of Offshore Wind

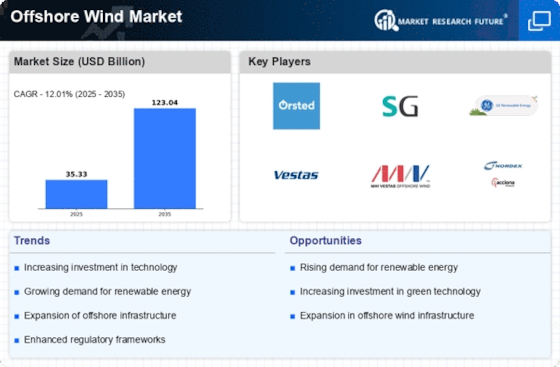

The offshore wind industry is experiencing an unprecedented level of competition, as a result of the speed with which technology is advancing, the regulatory framework, and the increasing demand for sustainable energy solutions. The leading players, including the equipment manufacturers, IT systems integrators, and the network operators, are using advanced technology such as advanced data analysis, automation, and IoT to optimize operations and reduce costs. The emergence of new entrants, especially those with a green and biometric focus, is disrupting established business models and challenging established players. As the regional opportunities for growth expand, particularly in Europe and Asia-Pacific, strategic trends are skewed towards the development of integrated solutions that combine renewable energy generation with smart grid technology. This dynamic industry landscape requires a thorough understanding of the technology-based differentiators that will define market share and competitive advantage in the years ahead.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions across the offshore wind value chain, from project development to operation.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Siemens Gamesa | Strong technology and service portfolio | Turbines and services | Global |

| Vestas | Leading turbine technology and innovation | Wind turbines and energy solutions | Global |

| Orsted | Expertise in offshore wind project execution | Project development and operation | Europe, North America |

| GE Renewable Energy | Advanced turbine technology and digital solutions | Wind turbines and grid solutions | Global |

Specialized Technology Vendors

These companies focus on specific technologies or innovations that enhance offshore wind efficiency and performance.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| MHI Vestas | High-capacity offshore wind turbines | Offshore wind turbines | Global |

| Nordex | Tailored solutions for diverse wind conditions | Wind turbines | Europe, Americas |

Infrastructure & Equipment Providers

These vendors supply essential infrastructure and equipment necessary for offshore wind installations and operations.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| RWE | Integrated energy solutions and expertise | Energy generation and infrastructure | Europe |

| Engie | Strong focus on sustainable energy solutions | Energy services and generation | Global |

| Iberdrola | Commitment to renewable energy leadership | Energy generation and infrastructure | Europe, Americas |

| EDP | Diverse renewable energy portfolio | Energy generation and management | Europe, Americas |

| Royal Dutch Shell | Transitioning to renewable energy solutions | Energy and infrastructure | Global |

| Shell New Energies | Focus on innovative energy solutions | Renewable energy projects | Global |

| Equinor | Strong offshore oil and gas expertise | Energy production and management | Europe, North America |

| Resilient Energy | Focus on sustainable energy solutions | Renewable energy projects | North America |

Emerging Players & Regional Champions

- c-power (Belgium) - Specializes in floating wind-turbines, has just landed a contract for a 300-megawatt offshore wind farm in the Belgian coast, and is challenging the established players by offering a novel solution that lowers the cost of the installation and increases the yield.

- Northland Power (Canada): a Canadian company which specializes in hybrid offshore wind and solar projects, and which has just announced a partnership to build a 400-megawatt offshore wind farm in the Great Lakes. The company complements traditional wind farm operators by combining solar energy with their projects to make them more viable.

- Iberdrola (Spain): It is well known for its strong presence in offshore wind. It has recently augmented its portfolio with a one-billion-kilowatt project in the North Sea, thereby establishing itself as a regional champion by bringing to bear its vast experience and resources to outstrip competitors.

- Vattenfall (Sweden): Offers advanced digital solutions for offshore wind farm management, recently implemented a predictive maintenance system in its North Sea projects, challenging traditional operational models and enhancing efficiency.

- RWE Renewables (Germany): Focuses on innovative turbine technology and energy storage solutions, recently launched a pilot project integrating battery storage with offshore wind, complementing existing wind farms by addressing intermittency issues.

Regional Trends: In 2024 the offshore wind energy market will be undergoing significant growth, particularly in Europe and North America, stimulated by government incentives and the drive for a greener energy policy. The trend in specialisation will be towards floating wind-farms and hybrid energy solutions, as companies seek to produce more energy with less impact on the environment.

Collaborations & M&A Movements

- Siemens Gamesa and Orsted entered a partnership to co-develop next-generation offshore wind turbine technology aimed at increasing efficiency and reducing costs, thereby strengthening their competitive positioning in the growing offshore wind sector.

- Equinor acquired a 50% stake in the Dogger Bank Wind Farm from SSE Renewables, enhancing its portfolio and market share in the UK offshore wind market, which is expected to see significant growth due to government support and regulatory incentives.

- Vestas and Ørsted announced a collaboration to optimize the supply chain for offshore wind projects in Europe, aiming to streamline operations and reduce lead times, which is crucial in a market facing increasing demand and regulatory pressures.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Turbine Technology | Siemens Gamesa, GE Renewable Energy | The SG14-222 DD windmill is renowned for its high capacity and efficiency, and has proved its worth in the North Sea. Its Haliade-X design, which has broken all previous records, has earned a reputation for innovation and a record-breaking performance. |

| Installation and Logistics | Van Oord, Jan De Nul | Vessels of the Van Oord type have greatly improved the offshore construction process. Jan de Nul’s expertise in heavy lift operations enables them to take on the most demanding projects. |

| Grid Integration | ABB, Siemens | ABB's HVDC technology has been pivotal in connecting offshore wind farms to the grid, enhancing stability and efficiency. Siemens' digital grid solutions facilitate real-time monitoring and management, improving overall grid performance. |

| Sustainability Practices | Ørsted, Vattenfall | rsted is a pioneer in the field of sustainability, and by 2025 we are aiming for zero emissions. The focus on the environment and nature in Vattenfall's offshore projects has set an industry standard. |

| Maintenance and Operations | Siemens Gamesa, MHI Vestas | Siemens Gamesa's predictive maintenance solutions leverage AI to reduce downtime, as seen in their service contracts in the UK. MHI Vestas has developed innovative service models that enhance operational efficiency and reduce costs for clients. |

| Digital Solutions | DNV GL, GE Renewable Energy | DNV GL's digital twin technology allows for enhanced monitoring and predictive analytics, improving project outcomes. GE's digital wind farm solutions optimize performance through data analytics, demonstrating significant operational improvements. |

Conclusion: Navigating the Offshore Wind Landscape

The offshore wind market in 2024 is characterized by intense competition and considerable fragmentation. Both established and new entrants are vying for market share. Regional trends show a shift towards more sustainable practices, and vendors are responding by enhancing their capabilities in AI, automation and flexibility to meet the requirements of changing regulations and consumers. The leading companies are able to rely on their established experience and expertise, while new entrants are able to use their innovations to disrupt traditional business models. Consequently, it is of critical importance that the leaders of tomorrow are able to integrate sustainable strategies into their operational strategies.

Leave a Comment