Rising Energy Demand

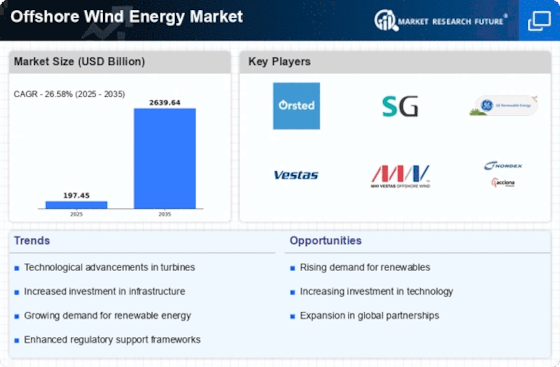

The Offshore Wind Energy Market is experiencing a surge in demand for renewable energy sources, driven by increasing global energy consumption. As populations grow and economies expand, the need for sustainable energy solutions becomes more pressing. According to recent estimates, energy demand is projected to rise by approximately 30% by 2040. This trend compels nations to invest in offshore wind energy, which offers a reliable and abundant source of power. The Offshore Wind Energy Market is well-positioned to meet this demand, as it harnesses the vast potential of wind resources located offshore, where wind speeds are typically higher and more consistent. Consequently, this driver is likely to catalyze further investments and technological innovations within the sector.

Technological Innovations

Technological advancements are playing a pivotal role in shaping the Offshore Wind Energy Market. Innovations in turbine design, installation techniques, and energy storage solutions are enhancing the efficiency and viability of offshore wind projects. For instance, the development of larger and more efficient turbines has the potential to increase energy output significantly. Recent reports suggest that the capacity of offshore wind farms could reach up to 10 MW per turbine by 2030, compared to the current average of 8 MW. These advancements not only improve the economic feasibility of offshore wind energy but also attract investments from various stakeholders. As technology continues to evolve, the Offshore Wind Energy Market is expected to witness accelerated growth and increased competitiveness.

Investment from Private Sector

The Offshore Wind Energy Market is witnessing a notable influx of investment from the private sector, driven by the increasing recognition of offshore wind as a viable energy source. Financial institutions and private investors are increasingly allocating capital to offshore wind projects, attracted by the potential for long-term returns and the growing demand for clean energy. Recent analyses indicate that investments in offshore wind energy could exceed USD 200 billion by 2030, reflecting a robust commitment to expanding capacity. This trend is further bolstered by partnerships between private companies and governments, which facilitate the development of large-scale offshore wind farms. As the Offshore Wind Energy Market continues to attract substantial investment, it is poised for significant expansion and innovation.

Government Incentives and Policies

The Offshore Wind Energy Market is greatly supported by favorable government policies and incentives aimed at promoting renewable energy. Many countries are implementing ambitious targets for renewable energy generation, with specific mandates for offshore wind capacity. For example, several nations have set goals to achieve 30% of their energy mix from offshore wind by 2030. These policies often include financial incentives, such as tax credits and grants, which encourage private investment in offshore wind projects. As governments recognize the economic and environmental benefits of offshore wind energy, the industry is likely to see a surge in project approvals and funding. This supportive regulatory landscape is crucial for the sustained growth of the Offshore Wind Energy Market.

Environmental Sustainability Initiatives

The Offshore Wind Energy Market is significantly influenced by the growing emphasis on environmental sustainability. Governments and organizations are increasingly recognizing the urgent need to reduce carbon emissions and combat climate change. Offshore wind energy presents a viable solution, as it generates electricity without emitting greenhouse gases. Recent data indicates that transitioning to renewable energy sources, including offshore wind, could reduce global carbon emissions by up to 70% by 2050. This commitment to sustainability is prompting nations to implement policies and incentives that favor the development of offshore wind projects. As a result, the Offshore Wind Energy Market is likely to benefit from enhanced regulatory frameworks and public support, fostering a conducive environment for growth.