Geopolitical Factors

Geopolitical dynamics are increasingly influencing the Offshore Pipeline Infrastructure Market, as countries navigate complex relationships regarding energy resources. Tensions in certain regions can lead to disruptions in supply chains, prompting nations to seek alternative routes for energy transportation. This situation creates opportunities for the development of new offshore pipelines that can bypass politically unstable areas. Additionally, collaborations between countries for joint pipeline projects may emerge as a strategy to enhance energy security. The interplay of these geopolitical factors is likely to shape investment decisions and project feasibility in the offshore pipeline infrastructure market, underscoring the need for strategic planning and risk assessment.

Increasing Energy Demand

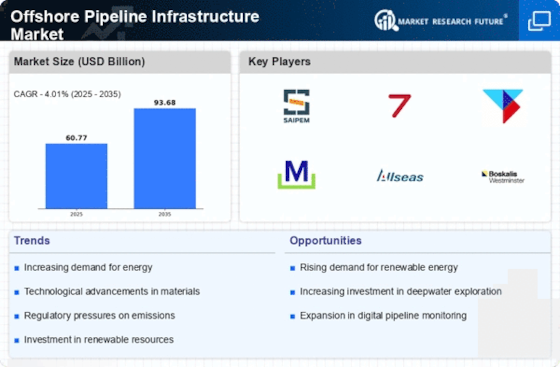

The Offshore Pipeline Infrastructure Market is experiencing a surge in demand for energy resources, driven by the growing global population and industrialization. As countries strive to meet their energy needs, the reliance on offshore oil and gas reserves has intensified. According to recent estimates, energy consumption is projected to rise by approximately 30% by 2040, necessitating the expansion of offshore pipeline networks. This trend indicates a robust market for offshore pipeline infrastructure, as companies invest in new projects to transport hydrocarbons efficiently. Furthermore, the shift towards cleaner energy sources may also lead to increased investments in offshore renewable energy projects, further bolstering the offshore pipeline infrastructure market.

Technological Innovations

Technological advancements are playing a pivotal role in shaping the Offshore Pipeline Infrastructure Market. Innovations such as advanced materials, automated monitoring systems, and enhanced construction techniques are improving the efficiency and safety of offshore pipelines. For example, the use of composite materials can reduce weight and increase durability, while real-time monitoring technologies can detect leaks and structural issues promptly. These innovations not only enhance operational efficiency but also reduce maintenance costs, making offshore projects more economically viable. As companies continue to adopt these technologies, the offshore pipeline infrastructure market is expected to expand, driven by the need for more reliable and efficient transportation of energy resources.

Regulatory Frameworks and Policies

The Offshore Pipeline Infrastructure Market is significantly influenced by evolving regulatory frameworks and policies aimed at ensuring safe and environmentally responsible operations. Governments are increasingly implementing stringent regulations regarding pipeline construction, maintenance, and decommissioning. For instance, the introduction of new safety standards and environmental assessments can impact project timelines and costs. However, these regulations also create opportunities for companies that can innovate and comply with these standards. The market is likely to see a rise in demand for advanced technologies that enhance safety and efficiency in offshore pipeline operations, thereby driving growth in the offshore pipeline infrastructure sector.

Investment in Infrastructure Development

The Offshore Pipeline Infrastructure Market is witnessing a significant influx of investment aimed at developing and upgrading existing infrastructure. Governments and private entities are recognizing the importance of robust pipeline systems to ensure energy security and economic growth. Recent reports indicate that investments in offshore pipeline projects are expected to reach several billion dollars over the next decade. This influx of capital is likely to facilitate the construction of new pipelines and the enhancement of existing ones, thereby increasing the overall capacity and efficiency of offshore energy transportation. Such developments are crucial for meeting the rising energy demands and ensuring the sustainability of offshore resources.