Rising Energy Demand

The Advanced Boiling Water Reactors Market is significantly influenced by the rising global energy demand. As populations grow and economies develop, the need for reliable and sustainable energy sources becomes increasingly critical. Advanced boiling water reactors offer a solution by providing a stable and low-carbon energy supply. According to recent projections, global electricity demand is expected to increase by 30% by 2040, creating a favorable landscape for nuclear energy. This rising demand is likely to drive investments in advanced reactor technologies, further propelling market growth.

Regulatory Frameworks

The Advanced Boiling Water Reactors Market benefits from supportive regulatory frameworks that promote the development and deployment of nuclear technologies. Governments are increasingly recognizing the role of nuclear energy in achieving energy security and reducing carbon emissions. Regulatory bodies are streamlining approval processes for new reactor designs, which encourages investment in advanced technologies. For example, the introduction of risk-informed regulations has facilitated the deployment of next-generation reactors. This supportive environment is expected to contribute to a steady increase in market size, with estimates suggesting a potential market value exceeding $50 billion by 2030.

Focus on Sustainability

The Advanced Boiling Water Reactors Market is aligned with the global focus on sustainability and reducing greenhouse gas emissions. As countries commit to ambitious climate goals, nuclear energy is being recognized as a viable alternative to fossil fuels. Advanced boiling water reactors produce minimal emissions during operation, making them an attractive option for meeting energy needs sustainably. The market is witnessing increased interest from both public and private sectors in developing reactors that utilize advanced fuel cycles, which can further enhance sustainability. This trend is expected to bolster market growth as stakeholders prioritize environmentally friendly energy solutions.

Technological Advancements

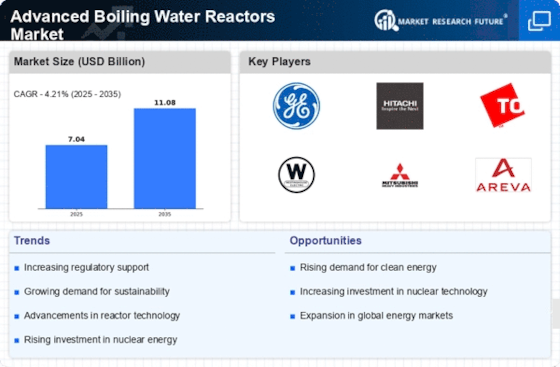

The Advanced Boiling Water Reactors Market is experiencing a surge in technological advancements that enhance reactor efficiency and safety. Innovations such as improved fuel designs and advanced control systems are being integrated into new reactor designs. These advancements not only increase the operational lifespan of reactors but also reduce waste generation. For instance, the introduction of digital instrumentation and control systems has been shown to improve operational reliability. As a result, the market is projected to grow at a compound annual growth rate of approximately 5% over the next decade, driven by these technological improvements.

Investment in Nuclear Infrastructure

The Advanced Boiling Water Reactors Market is poised for growth due to increased investment in nuclear infrastructure. Governments and private entities are recognizing the need to modernize existing facilities and build new reactors to meet future energy demands. This investment is not only aimed at expanding capacity but also at enhancing safety and efficiency through advanced technologies. Recent initiatives have seen billions allocated for the development of next-generation reactors, which are expected to play a crucial role in the energy mix. Such investments are likely to stimulate market growth, with projections indicating a robust expansion in the coming years.