Growth in Smart Transportation Systems

The speed sensor market in North America is significantly driven by the growth in smart transportation systems. As urbanization increases, cities are adopting intelligent transportation solutions to manage traffic flow and enhance mobility. Speed sensors are integral to these systems, providing real-time data that helps in traffic management and congestion reduction. The market for smart transportation is expected to reach $200 billion by 2025, with speed sensors being a vital component. This growth is fueled by the need for efficient transportation networks that can accommodate rising populations and vehicle numbers. Consequently, the demand for speed sensors is likely to surge as municipalities invest in technology to improve transportation efficiency and safety.

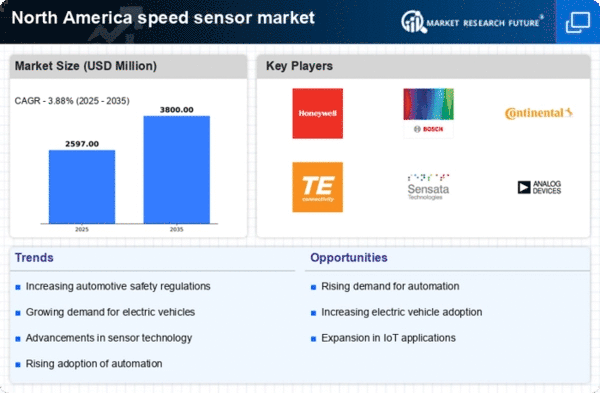

Increasing Automotive Safety Regulations

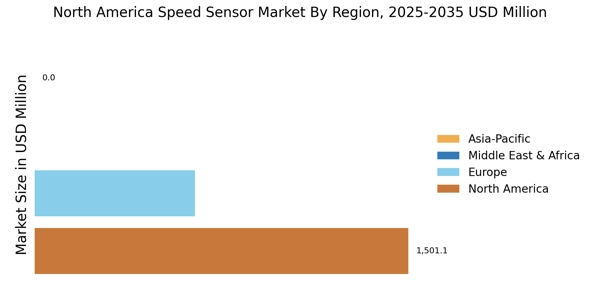

the North America speed sensor market is experiencing growth due to increasing automotive safety regulations. Governments are implementing stringent standards to enhance vehicle safety, which necessitates the integration of advanced speed sensors in vehicles. These regulations aim to reduce accidents and improve overall road safety. As a result, manufacturers are compelled to adopt innovative speed sensor technologies to comply with these regulations. The market is projected to reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 7.5%. This trend indicates a robust demand for speed sensors, as they play a crucial role in various safety systems, including anti-lock braking systems (ABS) and electronic stability control (ESC). Thus, the regulatory landscape significantly influences the speed sensor market in North America.

Technological Innovations in Sensor Design

The speed sensor market in North America is being propelled by technological innovations in sensor design. Advances in materials and manufacturing processes are leading to the development of more accurate, reliable, and cost-effective speed sensors. These innovations are crucial for meeting the demands of modern vehicles, which require high-performance sensors for various applications, including navigation and vehicle dynamics. The market for automotive sensors is projected to grow to $30 billion by 2025, with speed sensors representing a significant segment. This trend indicates that ongoing research and development efforts are likely to enhance the capabilities of speed sensors, thereby driving their adoption across multiple sectors within the automotive industry.

Expansion of Electric Vehicle Infrastructure

The speed sensor market in North America is poised for growth due to the expansion of electric vehicle (EV) infrastructure. As the adoption of EVs accelerates, there is a corresponding need for advanced speed sensors to optimize performance and energy efficiency. Charging stations and smart grid technologies require precise speed measurements to manage energy consumption effectively. The EV market is expected to reach $800 billion by 2027, with speed sensors playing a critical role in the development of these technologies. This expansion indicates a growing market for speed sensors, as they are essential for ensuring the reliability and efficiency of electric vehicles, thus contributing to the overall growth of the speed sensor market.

Rising Adoption of Advanced Driver Assistance Systems (ADAS)

the North America speed sensor market is benefiting from the rising adoption of Advanced Driver Assistance Systems (ADAS). These systems rely heavily on accurate speed measurements to function effectively, enhancing vehicle safety and driving experience. As consumers increasingly demand vehicles equipped with ADAS features, manufacturers are integrating sophisticated speed sensors into their designs. The market for ADAS is projected to grow at a CAGR of 15% over the next five years, indicating a substantial opportunity for speed sensor manufacturers. This trend suggests that the speed sensor market will continue to expand as automakers strive to meet consumer expectations for safety and convenience, thereby driving innovation in sensor technology.