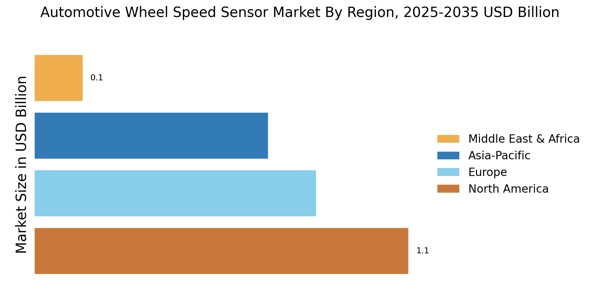

North America : Automotive Innovation Leader

North America is the largest market for automotive wheel speed sensors, holding approximately 40% of the global Automotive Wheel Speed Sensor Market share. The region's growth is driven by increasing vehicle production, advancements in automotive technology, and stringent safety regulations. The demand for electric vehicles (EVs) and autonomous driving features further propels the Automotive Wheel Speed Sensor Market, supported by government incentives for clean energy vehicles.

The United States and Canada are the leading countries in this region, with major automotive manufacturers investing heavily in sensor technology. Key players like Bosch, Honeywell, and Continental have established a strong presence, contributing to a competitive landscape. The focus on innovation and collaboration among industry stakeholders is expected to enhance Automotive Wheel Speed Sensor Market growth in the coming years.

Europe : Regulatory-Driven Market Growth

Europe is the second-largest market for automotive wheel speed sensors, accounting for around 30% of the global Automotive Wheel Speed Sensor Market share. The region's growth is significantly influenced by stringent environmental regulations and a strong push towards sustainable mobility solutions. The European Union's Green Deal and various national initiatives are driving the adoption of advanced automotive technologies, including wheel speed sensors, to enhance vehicle safety and efficiency.

Germany, France, and the UK are the leading countries in this market, with a robust automotive industry that fosters innovation. Major players like Continental and Denso are actively involved in developing advanced sensor technologies. The competitive landscape is characterized by collaborations between automotive manufacturers and technology firms, aiming to meet regulatory standards and consumer demands for safer and more efficient vehicles.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the automotive wheel speed sensor market, holding approximately 25% of the global Automotive Wheel Speed Sensor Market share. The region's expansion is driven by increasing vehicle production, rising disposable incomes, and a growing focus on vehicle safety features. Countries like China and India are leading this growth, supported by government initiatives to enhance automotive safety standards and promote electric vehicles.

China is the largest automotive market globally, with significant investments in sensor technology. Key players such as Denso and Hitachi are expanding their operations in this region to cater to the growing demand. The competitive landscape is evolving, with local manufacturers emerging alongside established global players, creating a dynamic market environment that fosters innovation and technological advancements.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the automotive wheel speed sensor market, holding about 5% of the global market share. The growth is primarily driven by increasing investments in infrastructure development and a rising number of vehicle registrations. Governments in this region are focusing on enhancing road safety and vehicle standards, which is expected to boost the demand for advanced automotive technologies, including wheel speed sensors. Countries like South Africa and the UAE are leading the market, with a growing automotive sector that attracts foreign investments. The competitive landscape is characterized by a mix of local and international players, with companies like Marelli and Sensata Technologies establishing a foothold. As the region continues to develop, the demand for innovative automotive solutions is anticipated to rise significantly.