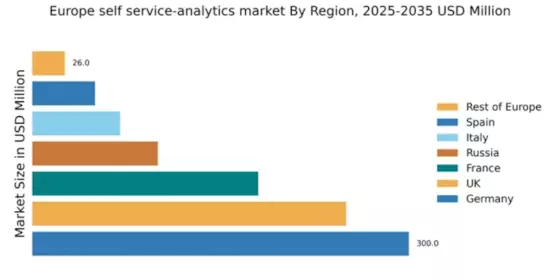

Germany : Strong Demand and Innovation Drive Growth

Key markets include major cities like Berlin, Munich, and Frankfurt, where a vibrant tech ecosystem thrives. The competitive landscape features significant players such as SAP, Microsoft, and Tableau, all vying for market share. Local dynamics are characterized by a strong focus on manufacturing, finance, and healthcare sectors, which increasingly rely on analytics for operational efficiency. The business environment is favorable, with a growing number of startups and established firms investing in self-service analytics solutions.

UK : Innovation and Investment Propel Demand

Key markets include London, Manchester, and Birmingham, where a diverse range of industries, including finance, retail, and technology, are leveraging analytics. The competitive landscape features major players like Microsoft, IBM, and Qlik, which dominate the market. The business environment is characterized by a high level of innovation and collaboration between tech firms and academic institutions, driving the development of tailored analytics solutions for specific industries.

France : Growing Demand Across Sectors

Key markets include Paris, Lyon, and Marseille, where industries such as retail, healthcare, and finance are increasingly utilizing analytics. The competitive landscape features players like SAP, Tableau, and Oracle, which are well-established in the region. The business environment is dynamic, with a growing number of startups focusing on analytics solutions, fostering innovation and competition in the market.

Russia : Market Potential and Challenges

Key markets include Moscow and St. Petersburg, where industries such as finance, telecommunications, and retail are adopting analytics solutions. The competitive landscape features both local and international players, including IBM and Qlik, which are establishing a presence in the market. The business environment is evolving, with a growing emphasis on digital transformation and innovation, although challenges remain in terms of regulatory compliance and market stability.

Italy : Focus on Digital Transformation

Key markets include Milan, Rome, and Turin, where sectors such as manufacturing, finance, and retail are leveraging analytics for operational efficiency. The competitive landscape features players like SAP and Microsoft, which are well-established in the region. The business environment is characterized by a growing number of startups focusing on analytics solutions, fostering innovation and competition in the market.

Spain : Growth Driven by Innovation

Key markets include Madrid and Barcelona, where industries such as retail, finance, and telecommunications are increasingly utilizing analytics. The competitive landscape features players like Microsoft and Tableau, which are well-established in the region. The business environment is dynamic, with a growing number of startups focusing on analytics solutions, fostering innovation and competition in the market.

Rest of Europe : Varied Growth Across Regions

Key markets include countries like Belgium, Netherlands, and Switzerland, where industries such as finance, healthcare, and manufacturing are increasingly adopting analytics solutions. The competitive landscape features a mix of local and international players, including Qlik and Tableau, which are establishing a presence in the market. The business environment is evolving, with a growing emphasis on digital transformation and innovation, although challenges remain in terms of regulatory compliance and market stability.