Regulatory Changes

Regulatory changes are playing a pivotal role in shaping the railroads market in North America. Recent adjustments in safety regulations and environmental standards are compelling rail operators to invest in cleaner technologies and more efficient practices. For example, the Federal Railroad Administration has introduced stricter emissions standards, which may lead to increased operational costs for some companies. However, these regulations also present opportunities for innovation and modernization within the industry. Companies that adapt to these changes may gain a competitive edge, as compliance can enhance their reputation and operational efficiency. The evolving regulatory landscape is thus a significant driver, influencing investment decisions and operational strategies in the railroads market.

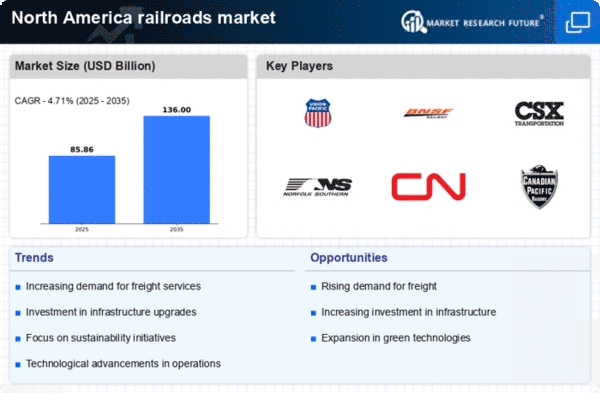

Freight Demand Growth

The railroads market is witnessing a notable increase in freight demand, driven by various economic factors. The growth of e-commerce and the need for efficient supply chain solutions are propelling the demand for rail freight services. In 2025, railroads are expected to transport over 1.5 trillion ton-miles of freight, reflecting a robust growth trajectory. This demand is further supported by the rising costs of trucking, which makes rail transport a more attractive option for shippers. As companies seek to optimize logistics and reduce costs, the railroads market stands to benefit significantly. This trend indicates a strong potential for revenue growth and expansion within the sector, as railroads adapt to meet the evolving needs of freight customers.

Infrastructure Investment

The railroads market in North America is currently experiencing a surge in infrastructure investment. Government initiatives, particularly at the federal level, are allocating substantial funds to enhance rail networks. For instance, the Infrastructure Investment and Jobs Act has earmarked approximately $66 billion for rail improvements. This funding is aimed at modernizing existing rail lines, expanding capacity, and improving safety measures. As a result, the railroads market is likely to see increased operational efficiency and reduced transit times. Enhanced infrastructure not only supports freight transport but also encourages passenger rail services, potentially leading to a more integrated transportation system. This investment trend appears to be a critical driver for growth in the railroads market, as it addresses both current deficiencies and future demands.

Technological Integration

Technological integration is emerging as a crucial driver in the railroads market, particularly in North America. The adoption of advanced technologies such as predictive analytics, IoT, and automation is transforming operations. Rail companies are increasingly utilizing data analytics to optimize routes, enhance maintenance schedules, and improve safety protocols. For instance, the implementation of automated train control systems is expected to reduce human error and increase efficiency. This technological shift not only enhances operational performance but also contributes to cost savings. As the industry embraces these innovations, the railroads market is likely to experience improved service reliability and customer satisfaction, positioning itself favorably in a competitive landscape.

Environmental Sustainability Efforts

Environmental sustainability efforts are becoming increasingly prominent within the railroads market in North America. As public awareness of climate change grows, rail companies are under pressure to adopt greener practices. Initiatives aimed at reducing carbon emissions and enhancing energy efficiency are gaining traction. For example, many railroads are investing in alternative fuel sources and electrification projects to minimize their environmental footprint. The shift towards sustainability not only aligns with regulatory requirements but also appeals to environmentally conscious consumers and businesses. This focus on sustainability is likely to drive innovation and investment in cleaner technologies, positioning the railroads market as a leader in sustainable transportation solutions.