Urbanization and Population Growth

The rapid urbanization in Japan is a pivotal driver for the railroads market. As cities expand, the demand for efficient public transportation systems intensifies. The population in urban areas is projected to reach approximately 80% by 2030, necessitating enhanced rail services. This urban growth compels investments in rail infrastructure, which is expected to exceed $100 billion by 2025. The railroads market must adapt to accommodate the increasing passenger volume, which is anticipated to rise by 15% over the next decade. Consequently, rail operators are likely to focus on expanding their networks and improving service frequency to meet the needs of a growing urban populace.

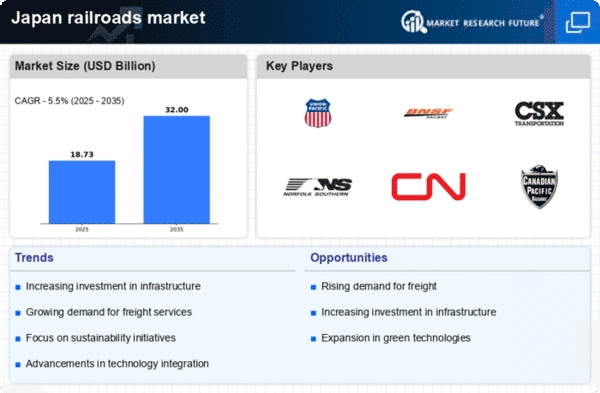

Economic Growth and Trade Expansion

Japan's economic growth and trade expansion are significant drivers for the railroads market. As the economy continues to recover, the demand for freight transportation is expected to rise. The railroads market is poised to benefit from increased trade activities, particularly with neighboring countries. The freight volume transported by rail is projected to grow by 10% over the next five years, driven by the need for efficient logistics solutions. Additionally, investments in rail infrastructure are likely to enhance connectivity, facilitating smoother trade routes. This economic momentum could lead to a more robust rail network, ultimately benefiting both passengers and freight services.

Government Policies and Regulations

Government policies play a crucial role in shaping the railroads market in Japan. The Japanese government has implemented various regulations aimed at enhancing safety and efficiency within the rail sector. For instance, the introduction of stricter safety standards has led to increased investments in technology and infrastructure. The government is also promoting the use of rail transport as a sustainable alternative to road transport, which could potentially reduce carbon emissions by 30% by 2030. These regulatory frameworks are likely to drive innovation and modernization within the railroads market, ensuring that it remains competitive and environmentally friendly.

Technological Integration and Innovation

The integration of advanced technologies is transforming the railroads market in Japan. Innovations such as automated train control systems and predictive maintenance are enhancing operational efficiency and safety. The adoption of AI and IoT technologies is expected to reduce operational costs by up to 20% over the next five years. Furthermore, the railroads market is witnessing a shift towards digital ticketing and real-time tracking systems, which improve customer experience. As technology continues to evolve, rail operators are likely to invest heavily in these advancements to maintain a competitive edge and meet the expectations of tech-savvy consumers.

Environmental Concerns and Sustainability

Environmental sustainability is increasingly influencing the railroads market in Japan. With growing awareness of climate change, there is a strong push towards reducing the carbon footprint of transportation systems. The railroads market is responding by investing in electrification and energy-efficient technologies. It is estimated that transitioning to electric trains could reduce greenhouse gas emissions by 40% compared to diesel alternatives. Additionally, the government is incentivizing the development of green rail projects, which may lead to a 25% increase in sustainable rail initiatives by 2027. This focus on sustainability is likely to reshape the industry's landscape, attracting environmentally conscious consumers.